Concept explainers

LO2 19 Interest Rate Risk. Both Bond Bill and Bond Ted have 6.2 percent coupons, make semiannual payments, and are priced at par value. Bond Bill has 5 years to maturity, whereas Bond Ted has 25 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Bill? Of Bond Ted? Both bonds have a par value of $1,000. If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Bill be then? Of Bond Ted? Illustrate your answers by graphing

To determine: The percentage change in bond price.

Introduction:

A bond refers to the debt securities issued by the governments or corporations for raising capital. The borrower does not return the face value until maturity. However, the investor receives the coupons every year until the date of maturity.

Bond price or bond value refers to the present value of the future cash inflows of the bond after discounting at the required rate of return.

Answer to Problem 19QP

The percentage change in bond price is as follows:

| Yield to maturity | Bond B | Bond T |

| 4.2% | 8.94% | 30.77% |

| 8.2% | (8.071%) | (21.12%) |

The interest rate risk is high for a bond with longer maturity, and the interest rate risk is low for a bond with shorter maturity period. The maturity period of Bond B is 5 years, and the maturity period of Bond T is 25 years. Hence, the Bond T’s bond price fluctuates higher than the bond price of Bond B due to longer maturity.

Explanation of Solution

Given information:

There are two bonds namely Bond B and Bond T. The coupon rate of both the bonds is 6.2 percent. The bonds pay the coupons semiannually. The price of the bond is equal to its par value. Assume that the par value of both the bonds is $1,000. Bond B will mature in 5 years, and Bond T will mature in 25 years.

Formulae:

The formula to calculate the bond value:

Where,

“C” refers to the coupon paid per period

“F” refers to the face value paid at maturity

“r” refers to the yield to maturity

“t” refers to the periods to maturity

The formula to calculate the percentage change in price:

Determine the current price of Bond B:

Bond B is selling at par. It means that the bond value is equal to the face value. It also indicates that the coupon rate of the bond is equal to the yield to maturity of the bond. As the par value is $1,000, the bond value or bond price of Bond B will be $1,000.

Hence, the current price of Bond B is $1,000.

Determine the current yield to maturity on Bond B:

As the bond is selling at its face value, the coupon rate will be equal to the yield to maturity of the bond. The coupon rate of Bond B is 6.2 percent.

Hence, the yield to maturity of Bond B is 6.2 percent.

Determine the current price of Bond T:

Bond T is selling at par. It means that the bond value is equal to the face value. It also indicates that the coupon rate of the bond is equal to the yield to maturity of the bond. As the par value is $1,000, the bond value or bond price of Bond T will be $1,000.

Hence, the current price of Bond T is $1,000.

Determine the current yield to maturity on Bond T:

As the bond is selling at its face value, the coupon rate will be equal to the yield to maturity of the bond. The coupon rate of Bond T is 6.2 percent.

Hence, the yield to maturity of Bond T is 6.2 percent.

The percentage change in the bond value of Bond B and Bond T when the interest rates rise by 2 percent:

Compute the new interest rate (yield to maturity) when the interest rates rise:

The interest rate refers to the yield to maturity of the bond. The initial yield to maturity of the bonds is 6.2 percent. If the interest rates rise by 2 percent, then the new interest rate or yield to maturity will be 8.2 percent

Compute the bond value when the yield to maturity of Bond B rises to 8.2 percent:

The coupon rate of Bond B is 6.2 percent, and its face value is $1,000. Hence, the annual coupon payment is $62

The yield to maturity is 8.2 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 4.1 percent

The remaining time to maturity is 5 years. As the coupon payment is semiannual, the semiannual periods to maturity are 10

Hence, the bond price of Bond B will be $919.29 when the interest rises to 8.2 percent.

Compute the percentage change in the price of Bond B when the interest rates rise to 8.2 percent:

The new price after the increase in interest rate is $919.29. The initial price of the bond was $1,000.

Hence, the percentage decrease in the price of Bond B is (8.071 percent) when the interest rates rise to 8.2 percent.

Compute the bond value when the yield to maturity of Bond T rises to 8.2 percent:

The coupon rate of Bond T is 6.2 percent, and its face value is $1,000. Hence, the annual coupon payment is $62

The yield to maturity is 8.2 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 4.1 percent

The remaining time to maturity is 25 years. As the coupon payment is semiannual, the semiannual periods to maturity are 50

Hence, the bond price of Bond T will be $788.8075 when the interest rises to 8.2 percent.

Compute the percentage change in the price of Bond T when the interest rates rise to 8.2 percent:

The new price after the increase in interest rate is $788.8075. The initial price of the bond was $1,000.

Hence, the percentage decrease in the price of Bond T is (21.12 percent) when the interest rates rise to 8.2 percent.

The percentage change in the bond value of Bond B and Bond T when the interest rates decline by 2 percent:

Compute the new interest rate (yield to maturity) when the interest rates decline:

The interest rate refers to the yield to maturity of the bond. The initial yield to maturity of the bonds is 6.2 percent. If the interest rates decline by 2 percent, then the new interest rate or yield to maturity will be 4.2 percent

Compute the bond value when the yield to maturity of Bond B declines to 4.2 percent:

The coupon rate of Bond B is 6.2 percent, and its face value is $1,000. Hence, the annual coupon payment is $62

The yield to maturity is 4.2 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 2.1 percent

The remaining time to maturity is 5 years. As the coupon payment is semiannual, the semiannual periods to maturity are 10

Hence, the bond price of Bond B will be $1,089.36 when the interest declines to 4.2 percent.

Compute the percentage change in the price of Bond B when the interest rates decline to 4.2 percent:

The new price after the increase in interest rate is $1,089.36. The initial price of the bond was $1,000.

Hence, the percentage increase in the price of Bond B is 8.94 percent when the interest rates decline to 4.2 percent.

Compute the bond value when the yield to maturity of Bond T declines to 4.2 percent:

The coupon rate of Bond T is 6.2 percent, and its face value is $1,000. Hence, the annual coupon payment is $62

The yield to maturity is 4.2 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 2.1 percent

The remaining time to maturity is 25 years. As the coupon payment is semiannual, the semiannual periods to maturity are 50

Hence, the bond price of Bond T will be $1,307.73 when the interest declines to 4.2 percent.

Compute the percentage change in the price of Bond T when the interest rates decline to 4.2 percent:

The new price after the increase in interest rate is $1,307.73. The initial price of the bond was $1,000.

Hence, the percentage increase in the price of Bond T is 30.77 percent when the interest rates decline to 4.2 percent.

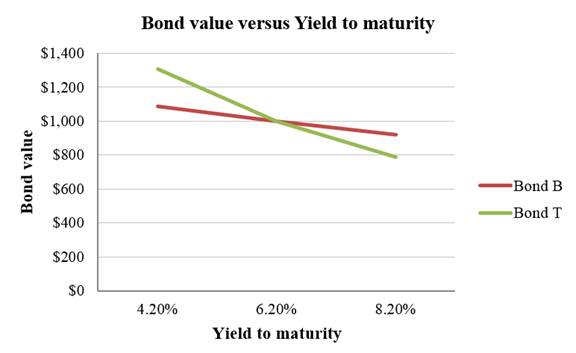

A summary of the bond prices and yield to maturity of Bond B and Bond T:

Table 1

|

Yield to maturity |

Bond B | Bond T |

| 4.2% | $1,089.36 | $1,307.73 |

| 6.2% | $1,000.00 | $1,000.00 |

| 8.2% | $919.29 | $788.81 |

A graph indicating the relationship between bond prices and yield to maturity based on Table 1:

Interpretation of the graph:

The above graph indicates that the price fluctuation is higher in a bond with higher maturity. Bond T has a maturity period of 25 years. As its maturity period is longer, its price sensitivity to the interest rates is higher. Bond B has a maturity period of 5 years. As its maturity period is shorter, its price sensitivity to the interest rates is lower. Hence, a bond with longer maturity is subject to higher interest rate risk.

Want to see more full solutions like this?

Chapter 6 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- 6. Pure expectations theory The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. A. Based on the pure expectations theory, is the following statement true or false? The pure expectations theory assumes that a one-year bond purchased today will have the same return as a one-year bond purchased five years from now. False True B. The yield on a one-year Treasury security is 5.8400%, and the two-year Treasury security has a 8.7600% yield. Assuming that the pure expectations theory is correct, what is the market’s estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.) 14.936% 13.4071% 11.7606% 9.9965% C. Recall that on a one-year Treasury security the yield is 5.8400% and 8.7600% on a two-year Treasury security. Suppose the one-year security does not have a…arrow_forwardIllustrate your answers by graphing bond prices versus time to LO 2 19. Interest Rate Risk Both Bond Bill and Bond Ted have 5.8 percent coupons, make semiannual payments, and are priced at par value. Bond Bill has 5 years to maturity, whereas Bond Ted has 25 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Bill? Of Bond Ted? Both bonds have a par value of $1,000. If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Bill be then? Of Bond Ted? Illustrate your answers by graphing bond prices versus YTM. What does this problem tell you about the interest rate risk of longer-term bonds?arrow_forward26. Suppose that a long-term coupon bond with a coupon rate of 5% is purchased today at its face value of $1,000 and resold a year later for a price of $950. The holding period return for the bond is equal to: a. 0% b. 2% c. 3% d. 5% 27. A decrease in the market interest rate will cause the value of a bank's portfolio of fixed-payment loans to: a. rise b. fall c. remain unchanged d. rise or fall, depending on the maturity of the bonds 28. A risk-free consol provides an annual payment of $50. If the market interest rate is 5%, the price of the consol will be: a. $55 b. $500 c. $1,000 d. $1,050arrow_forward

- = = Problem 2 Currently the yield curve observed in the market is as follows: yı 6%, Y2 = 7%, and yз 9%. You are choosing between a two-year and three-year maturity bonds all paying annual coupons of 8%, once a year. You strongly believe that at the end of year 1 the yield curve will become flat at 9%. (1) Which bond (and why) should you buy if you plan to close out your position in one year right after receiving the coupon payment? (2) Suppose that you can either invest in a two-year bond described above, or invest in a 1-year bank deposit with an annual interest rate of 6%. As in (a), your investment horizon is 1 year. Which option would you choose and why?arrow_forward-7 The YTM on a bond is the interest rate you earn on your investment if interest rates don't change. If you actually sell the bond before it matures, your realized return is known as the holding period yield (HPY). a. Suppose that today you buy a bond with an annual coupon of 12 percent for $1,140. The bond has 19 years to maturity. What rate of return do you expect to earn on your investment? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b- Two years from now, the YTM on your bond has declined by 1 percent and you 1. decide to sell. What price will your bond sell for? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b- What is the HPY on your investment? (Do not round intermediate calculations and 2. enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Expected rate of retum. b-1. Bond price b-2. HPY %arrow_forwardPlease only use 1 excel formula/cell to solve the the following question: Bond J has a coupon rate of 3%. Bond K has a coupon rate of 9%. Both bonds have 19 years to maturity, make semiannual payments, and have a YTM of 6%. If interest rates suddenly rise by 2%, what is the percentage price change of these bonds? What if rates suddenly fall by 2% instead? All bond price answers should be dollar prices. Bond J: Coupon Rate 3% Settlement Date 1/1/2000 Maturity Date 1/1/2019 Redemption (% of par) 100 Number of Coupons Per Year 2 Bond K: Coupon Rate 9% Settlement Date 1/1/2000 Maturity Date 1/1/2019 Redemption (% of par) 100 Number of Coupons Per Year 2 Par Value for Both Bonds $1,000 Current YTM 6% New YTM 8% New YTM 4%arrow_forward

- You skipped this question in the previous attempt. Problem 6-19 Interest Rate Risk (LO3) Consider three bonds with 5.00% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years. a. What will be the price of the 4-year bond if its yield increases to 6.00%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will be the price of the 8-year bond if its yield increases to 6.00%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. What will be the price of the 30-year bond if its yield increases to 6.00%? (Do not round intermediate calculations. Round answer to 2 decimal places.) d. What will be the price of the 4-year bond if its yield decreases to 4.00%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) e. What will be…arrow_forwardBond J has a coupon rate of 3 percent. Bond K has a coupon rate of 9 percent. Both bonds have 18 years to maturity, make semiannual payments, and have a face value of $1000 and a YTM of 6 percent. a. If interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds? What if rates suddenly fall by 2 percent instead? (Hint: % price change = 100% * (new price - old price)/old price) b. What does this problem tell you about the interest rate risk of lower coupon bonds? -arrow_forward9 You skipped this question in the previous attempt. 6 Problem 6-19 Interest Rate Risk (LO3) Consider three bonds with 5.00% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years. ts a. What will be the price of the 4-year bond if its yield increases to 6.00%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will be the price of the 8-year bond if its yield increases to 6.00%? (Do not round intermediate calculations. Round answer to 2 decimal places.) c. What will be the price of the 30-year bond if its yield increases to 6.00%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. What will be the price of the 4-year bond if its yield decreases to 4.00%? (Do not round intermediate calculations. Round answer to 2 decimal places.) e. What will…arrow_forward

- Q1: A 20-year bond has a coupon rate of 8 percent, and another bond of the same maturity has a coupon rate of 15 percent. If the bonds are alike in all other respects, which will have the greater relative market price decline if interest rates increase sharply? Why?arrow_forwardD6 Assume you own a 2-year US Treasury Note with a 5% coupon and a 7-year US Treasury Note with a 0% coupon. If market interest rates decrease by 100 basis points in the 2-year maturity and declined by only 75 basis points in the 7-year maturity, which bond would experience the smallest market value change? a. 5% US Treasury due in 2 years b. 0% US Treasury due in 7 years c. Both would change by the same amount d. Prices would not change since the coupons are fixedarrow_forwardBond Jis a 3% coupon bond. Bond K is a 9% coupon bond. Both bonds have 15 years to maturity, make semiannual payments, and have a YTM of 6%. If interest rates suddenly rise by 2%, what is the percentage price change of these bonds? What if rates suddenly fall by 2% instead? What does this problem tell you about the interest rate risk of lower coupon bonds?arrow_forward