Concept explainers

a)

To calculate: The annual percentage rate and the effective annual rate

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is also represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

a)

Answer to Problem 77QP

The annual percentage rate is 390%, the effective annual rate is 4,197.74%

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake-up consumers. The store offers a week loan at the rate of interest of 7.5% per week. Then, after few days, the store again makes a one-week loan at a discount interest rate of 7.5% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 7.5% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $33.55. As this is a discount interest rate, the net proceeding of Person X will be $66.45. Thus, Person X has to pay $100 for a month and the store also lets Person X to pay $25 in installments for a week.

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate with the number of months in a year. Here, the interest is calculated per week and so the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 390%

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 0.41,9774 or 4,197.74%

b)

To calculate: The annual percentage rate and the effective annual rate

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is also represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

b)

Answer to Problem 77QP

The annual percentage rate is 421.62%, the effective annual rate is 5,662.75%

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake-up consumers. The store offers a week loan at the rate of interest of 7.5% per week. Then, after few days, the store again makes a one-week loan at a discount interest rate of 7.5% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 7.5% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $33.55. As this is a discount interest rate, the net proceeding of Person X will be $66.45. Thus, Person X has to pay $100 for a month and the store also lets Person X to pay $25 in installments for a week.

Explanation:

In the discount loan, the amount that Person X gets is reduced by the discount and Person X has to pay back the full principal value. With the discount of 7.5%, Person X receives $9.25 for each $10 as the principal value. The weekly interest rates are calculated as follows:

Note: The dollar values that are used above are not relevant. In other words, it can also be written as $0.925 and $1 or $92.5 and $100 or in any other combination that provides similar rate of interest.

Hence, the r value is 0.0811 or 8.11%

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate with the number of months in a year. Here, the interest is calculated per week and so the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 421.62%

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 56.6275 or 5,662.75%

c)

To calculate: The annual percentage rate and the effective annual rate

Introduction:

The annual rate that is earned from the investment or charged for a borrowing is an annual percentage rate and it is also represented as APR. Thus, the APR is calculated by multiplying the rate of interest for a year with the number of months in a year. The effective annual rate is the rate of interest that is expressed as if it were compounded once in a year.

c)

Answer to Problem 77QP

The annual percentage rate is 968.19%, the effective annual rate is 717,745.21%

Explanation of Solution

Given information:

A check-cashing store makes a personal loan to wake-up consumers. The store offers a week loan at the rate of interest of 7.5% per week. Then, after few days, the store again makes a one-week loan at a discount interest rate of 7.5% for a week. The store also makes an add-on interest on the loan at a discount interest rate of 7.5% for a week.

Thus, if Person X borrows $100 for 4 weeks, the interest would be $33.55. As this is a discount interest rate, the net proceeding of Person X will be $66.45. Thus, Person X has to pay $100 for a month and the store also lets Person X to pay $25 in installments for a week.

Explanation:

In this part, the

Formula to calculate the present value annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period. Using the formulae of the present value of annuity, the interest rate is computed using the spreadsheet method.

Compute the present value annuity:

Compute the interest rate using the spreadsheet:

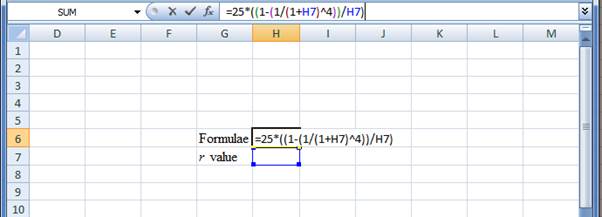

Step 1:

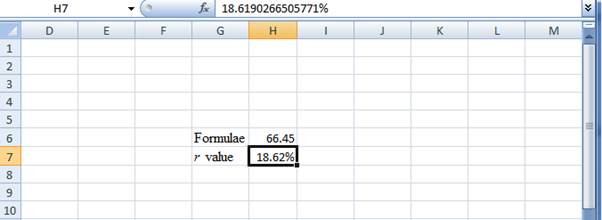

- Type the formulae of the present value annuity in H6 in the spreadsheet and consider the r value as H7

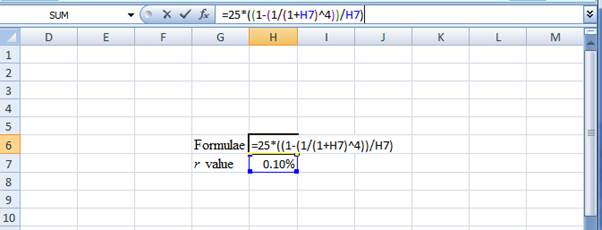

Step 2:

- Assume the r value as 0.10%

Step 3:

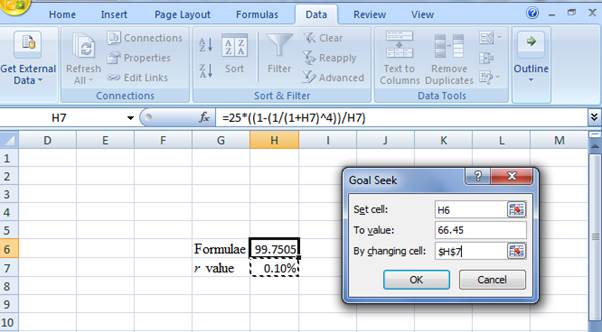

- In the spreadsheet, go to Data and select What-If-Analysis.

- Under What-If-Analysis, select Goal Seek

- In set cell, select H6 (the formula)

- The To value is considered as 66.45 (the value of the present value of annuity)

- The H7 cell is selected for the 'by changing cell.'

Step 4:

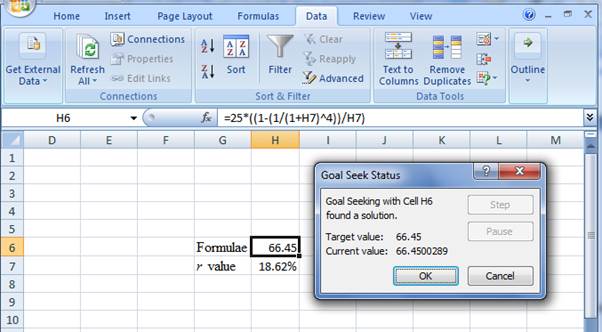

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the r value

Step 5:

- The r value appears to be 18.6190266505771%

Hence, the r value is 18.62%

Compute the annual percentage rate:

Note: The annual percentage rate is computed by multiplying the interest rate with the number of periods in a year. Here, the interest is calculated per week and so the number of weeks in a year (52 weeks) is taken as the period.

Hence, the annual percentage rate is 968.19%

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate is 7,177.4521 or 717,745.21%.

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamentals of Corporate Finance

- Q5. If you were opening a savings account with compound interest, would you prefer an account that offers annual compounding, quarterly compounding, or daily compounding? Why? Q6. Why should investors consider common stocks as an investment vehicle if they have a long-term time horizon? Q7. Is online grocery shopping cheaper? Q8. What can you realistically do to improve your income level?Q9. If you have too many credit cards, what should you do? Q.10 What is the formula for calculating your net worth?arrow_forward8. Suppose that the balance of a certain credit card is P43,744.53. The credit card company charges 3.5% per month. How much is the total balance owed to the credit card company? 9. A buyer purchased an item worth P10,000 with no down payment at 0.85% per month for 24 months. What is the monthly payment? How much is the finance charge? Evaluatearrow_forwardWhat steps are used to calculate the average daily balance? Many credit cards charge an 18%-24% annual interest. Do you think this is fair? Do you think this is a justifiable rate? Should rates be lower for certain age groups or individuals or for different types of credit cards or for different income levels and if so why or why not? Defend your answer.arrow_forward

- You just received an offer in the mail to transfer the $5,000 balance from your current credit card, which charges an annual rate of 18.7 percent, to a new credit card charging a rate of 7.9 percent. You plan to make payments of $250 a month on this debt. How many fewer payments will you have to make to pay off this debt if you transfer the balance to the new card? Group of answer choices 2.48 3.10 2.86 2.79 2.64arrow_forward5) According to a recent WalletHub report, the average credit card balance is $10,848 per American household, at an average 22.75% APR. How long will it take for a credit card balance of $10,848 to be paid off with monthly $40 minimum payments? How much interest will the credit card debt cost?arrow_forwardWhy is some trade credit called free while other credit is called costly? If a firm buys on terms of2/10, net 30, pays at the end of the 30th day, and typically shows $300,000 of accounts payableon its balance sheet, would the entire $300,000 be free credit, would it be costly credit, or wouldsome be free and some costly? Explain your answer. No calculations are necessary.arrow_forward

- A bank has estimated its expected (predicted) loan loss rate on its consumer loans at 3.25%. If the bank wishes to earn 8% on it consumer loans, what rate should it charge its customers? 11.34% 11.63% 4.60% 4.35% The following is not an example of a closed-end loan Automobile Loans Home mortgages Recreational vehicle loan Credit Card Core deposits of a commercial bank consist of the following except: Demand deposits Savings deposits Money market deposits Eurodollar depositsarrow_forwardA bank has estimated its expected (predicted) loan loss rate on its consumer loans at 3.25%. If the bank wishes to earn 8% on it consumer loans, what rate should it charge its customers?arrow_forward1. Cash Discounts [LO1] You place an order for 300 units of inventory at a unit price of $140. The supplier offers terms of 1/10, net 30. a. How long do you have to pay before the account is overdue? If you take the full period, how much should you remit? b. What is the discount being offered? How quickly must you pay to get the discount? If you do take the discount, how much should you remit? 701 c. If you don't take the discount, how much interest are you paying implicitly? How many days’ credit are you receiving?arrow_forward

- Tai Credit Corp. wants to earn an effective annual return on its consumer loans of 16.5 percent per year. The bank uses daily compounding on its loans. What interest rate is the bank required by law to report to potential borrowers? Explain why this rate is misleading to an uninformed borrower.arrow_forwardMarcus is trying to decide which checking account to open. Bank A's account pays 1.6%, compounded annually. Bank Q's account pays 0.4% compounded quarterly. Which account will produce the highest return? Question 14 options: Bank A Bank Q They are the Samearrow_forwardExplain the Formula Otherwise I will dislike.. 1) A credit card company charges an interest rate of 1.13% per quarter on the unpaid balance of all accounts. What would be the effective rate of interest per year being charged by the company? The annual effective rate would be 4.52% The annual effective rate would be 4.60% The annual effective rate would be 4.13% The annual effective rate would be 1.13%arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education