Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 6MAD

Analyze and compare Alphabet (Google) and Microsoft

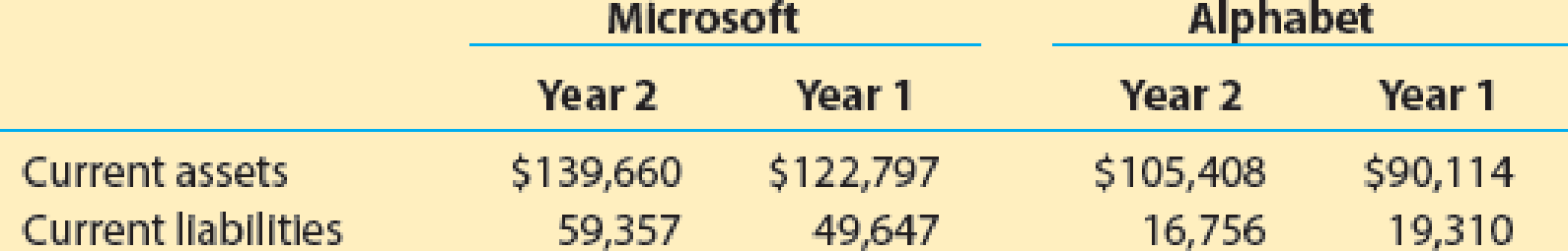

Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Alphabet’s primary source of revenue is from advertising, while Microsoft’s is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies:

- a. Compute the

working capital for each company for both years. - b. Which company has the larger working capital at the end of Year 2?

- c. Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

- d. Compute the

current ratio for both companies. Round to one decimal place. - e. Which company has the larger relative liquidity based on the current ratio?

- f. Based on your analysis, comment on the short-term debt-paying ability of these two companies.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Macon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $40 million. Total assets were $470 million, non-interest-bearing current liabilities were $72,000,000. What are the invested capital and ROI for Macon?

Solution

What is the invested capital (Total Assets – Non-Interest-Bearing Current Liabilities)?

What is the ROI (Net Income/Invested Capital)?

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics,

including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost

of capital. The balance sheet and some other information are provided below.

Assets

Current Assets

Net, plant, property, and equipment

Total assets

$

$

$

Liabilities and Equity

Accounts payable

Accruals

Current Liabilities

Long-term debt (40,000 bonds, $1,000 par valu $

Total liabilities

$

Common stock (10,000,000 shares)

$

Retained earnings

Total shareholders equity

Total liabilities and shareholder's equity

$

$

$

$

$

$

38,000,000

101,000,000

139,000,000

10,000,000

9,000,000

19,000,000

40,000,000

59,000,000

30,000,000

50,000,000

80,000,000

139,000,000

The Stock is currently selling $15.25 per share, and its noncallable $1000 par value, 20 year, 7.25% bonds

semiannual payments are selling for $875. The beta is 1.25, the yield on a 6-month treasury bill is 3.50%

and the yield on a…

Income statements illustrate what revenues the firm collects, the expenses required to support revenues, and the firm's profitability over a specified

period of time. While balance sheets are a "snapshot" of the firm's status on a specific date, income statements reflect performance over a period of

time. Publicly held companies generate income statements every quarter (three months) and for their annual report.

INCOME STATEMENT

(Thousands of dollars)

Net revenues

- Cost of goods sold

- Operating expenses

- Research & development expense

Operating costs excluding depreciation

- Depreciation and amortization expense

Operating income (EBIT)

- Interest expense

Taxable income

- Taxes

Net income

- Preferred dividends

Net income available to common shareholders

Dividends

Addition to retained earnings

The gross margin for this fictional company is:

O 14.7%

O 9.2%

18.2%

60.3%

O 33.3%

$

$

On the income statement, interest expense is

$

Wages are considered a(n)

$

$

In this example, the firm pays…

Chapter 4 Solutions

Financial And Managerial Accounting

Ch. 4 - Why do some accountants prepare an end-of-period...Ch. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Which step of the accounting cycle is optional?Ch. 4 - Prob. 10DQ

Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Prob. 2BECh. 4 - Classified balance sheet The following accounts...Ch. 4 - Closing entries After the accounts have been...Ch. 4 - Accounting cycle From the following list of steps...Ch. 4 - Working capital and current ratio Current assets...Ch. 4 - Flow of accounts into financial statements The...Ch. 4 - Classifying accounts Balances for each of the...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Financial statements from the end-of-period...Ch. 4 - Income statement The following account balances...Ch. 4 - Income statement; net loss The following revenue...Ch. 4 - Income statement FedEx Corporation (FDX) had the...Ch. 4 - Statement of stockholders equity Climate Control...Ch. 4 - Statement of stockholders equity; net loss...Ch. 4 - Classifying assets Identify each of the following...Ch. 4 - Balance sheet classification At the balance sheet...Ch. 4 - Balance sheet Dynamic Weight Loss Co. offers...Ch. 4 - Balance sheet The following balance sheet was...Ch. 4 - Identifying accounts to be closed From the list...Ch. 4 - Closing entries with net income Automation...Ch. 4 - Closing entries with net loss Summit Services Co....Ch. 4 - Identifying permanent accounts Which of the...Ch. 4 - Post-closing trial balance An accountant prepared...Ch. 4 - Steps in the accounting cycle Rearrange the...Ch. 4 - Completing an end-of-period spreadsheet List (a)...Ch. 4 - Appendix 1 Adjustment data on an end-of-period...Ch. 4 - Prob. 22ECh. 4 - Appendix 1 Financial statements from an...Ch. 4 - Appendix 1 Adjusting entries from an end-of-period...Ch. 4 - Prob. 25ECh. 4 - Reversing entry The following adjusting entry for...Ch. 4 - Adjusting and reversing entries On the basis of...Ch. 4 - Adjusting and reversing entries On the basis of...Ch. 4 - Entries posted to wages expense account Portions...Ch. 4 - Entries posted to wages expense account Portions...Ch. 4 - Financial statements and closing entries Beacons...Ch. 4 - Financial statements and closing entries Foxy...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - Financial statements and closing entries Last...Ch. 4 - Financial statements and closing entries The...Ch. 4 - T accounts, adjusting entries, financial...Ch. 4 - Ledger accounts, adjusting entries, financial...Ch. 4 - Complete accounting cycle For the past several...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - Analyze and compare Amazon.com to Best Buy...Ch. 4 - Analyze and compare Zynga, Electronic Arts, and...Ch. 4 - Analyze and compare Foot Locker and The Finish...Ch. 4 - Analyze Under Armour The following year-end data...Ch. 4 - Prob. 5MADCh. 4 - Analyze and compare Alphabet (Google) and...Ch. 4 - Prob. 1TIFCh. 4 - Your friend, Daniel Nat, recently began work as...Ch. 4 - Prob. 4TIFCh. 4 - Prob. 5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The income statement comparison for Rush Delivery Company shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the ROI. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the RI for each year. Explain how this compares to your findings in part C.arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. A. In the correct format, prepare the income statement using the following information: B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital. C. Prepare a short response to accompany the income statement that explains why uncontrollable costs are included in the income statement.arrow_forwardNeiman Marcus Group (NMG) is one of the largest luxury fashion retailers in the world. Kohls Corporation (KSS) sells moderately priced private and national branded products through more than 1,100 department stores located throughout the United States. The current assets and current liabilities at the end of a recent year for both companies are as follows (in millions): a. Would an analysis of working capital between the two companies be meaningful? Explain. b. Compute the quick ratio for both companies. Round to one decimal place. c. Interpret your results.arrow_forward

- The income statement comparison for Forklift Material Handling shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the return on investment. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the residual income for each year. Explain how this compares to your findings in part C.arrow_forwardAssume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below. Assets Current assets Net plant, property, and equipment Total assets Liabilities and Equity Accounts payable Accruals Current liabilities Long-term debt (40,000 bonds, $1,000 par value) Total liabilities Common stock (10,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity b. 15.88% The stock is currently selling for $23.35 per share, and its noncallable $1,000.00 par value, 25-year, 12.00% bonds with semiannual payments are selling for $912.28. The beta is 1.08, the yield on a 6-month Treasury bill is 4.00%, and the yield on a 25-year Treasury bond is 6.00%. The required return on the stock market is 12.00%, but the market has had an average annual…arrow_forwardMacon Mills is a division of Bolin Products, Inc. During the most recent year, Macon had a net income of $40 million. Total assets were $470 million, non-interest-bearing current liabilities were $72,000,000. What are the invested capital and ROI for Macon? Solution What is the invested capital (Total Assets – Non-Interest-Bearing Current Liabilities)? What is the ROI (Net Income/Invested Capital)? Please don't provide answer in image format thank youarrow_forward

- Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitized Corp. and Very Network, Inc. and have assembled the following data. LOADING... (Click to view the income statement data.) Data Table Selected income statement data for the current year: Digitized Very Network Net Sales Revenue (all on credit) $418,290 $494,940 Cost of Goods Sold 210,000 256,000 Interest Expense 0 15,000 Net Income 62,000 70,000 (Click to view the balance sheet and market price data.) Data Table Selected balance sheet and market price data at the end of the current year: Digitized Very Network Current Assets: Cash $24,000 $21,000 Short-term Investments 42,000 19,000 Accounts Receivables, Net 36,000 46,000 Merchandise Inventory 67,000 98,000 Prepaid Expenses 22,000 18,000 Total…arrow_forwardUsing the data in the following table for a number of firms in the same industry, do the following: Firm (in Millions of Dollars) A B C D Sales $15 $10 $15 $30 Net income after tax 1.75 0.50 2.00 1.50 Total assets 6.0 18.0 8.0 15.5 Stockholders' equity 13.0 10.0 6.0 5.0 Compute the total asset turnover, the net profit margin, the equity multiplier, and the return on equity for each firm. Round your answers to two decimal places. A B C D Total Asset Turnover x x x x Net Profit Margin Equity Multiplier x x x x Return on Equity Evaluate each firm’s performance by comparing the firms with one another. Which firm has the lowest total asset turnover value?-Select-Firm AFirm BFirm CFirm DItem 17Which firm has the lowest net profit margin value?-Select-Firm AFirm BFirm CFirm DItem 18Which firm has the lowest equity multiplier value?-Select-Firm AFirm BFirm CFirm DItem 19Which firm has the lowest return on equity value?-Select-Firm…arrow_forwardBustamante Company has income from operations of $24,480, invested assets of $85,000, and sales of $204,000. Use the DuPont formula to compute the return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. If required, round your answers to two decimal places. a. Profit margin fill in the blank 1% b. Investment turnover fill in the blank 2 c. Return on investment fill in the blank 3%arrow_forward

- Find online the annual 10-K report for Costco Wholesale Corporation (COST) for fiscal year 2015 (filed in October 2015). a. Compute Costco's net profit margin, total asset turnover, and equity multiplier. b. Verify the DuPont Identity for Costco's ROE. c. If Costco's managers wanted to increase its ROE by 1 percentage point, how much higher would their asset turnover need to be? a. Compute Costco's net profit margin, total asset turnover, and equity multiplier. The net profit margin is %. (Round to two decimal places.) The total asset turnover is (Round to two decimal places.) The equity multiplier is (Round to two decimal places.) b. Verify the DuPont Identity forCostco's ROE. The ROE is %. (Round to two decimal places.) c. If Costco's managers wanted to increase its ROE by 1 percentage point, how much higher would their asset turnover need to be? The total assets turnover should be (Round to two decimal places.) The total asset turnover should be % (Round to two decimal places and…arrow_forwardFor fiscal year 2018, Walmart Inc. (WMT) had total revenues of $500.34 billion, net income of $9.86 billion, total assets of $204.52 billion, and total shareholders' equity of $77.87 billion. a. Calculate Walmart's ROE directly, and using the DuPont Identity. b. Comparing with the data for Costco, use the DuPont Identity to understand the difference between the two firms' ROES. Data table For fiscal year 2018, Costco Wholesale Corporation (COST) had a net profit margin of 2.08%, asset turnover of 3.55, and a book equity multiplier of 3.37. Costco's ROE (DuPont) is 24.88%.arrow_forwardCarter Paint Company has plants in four provinces. Sales last year were $100 million, and the balance sheet year-end is similar in percent of sales to that of previous years (and this will continue in the future). All assets and current liabilities will vary directly with sales. Assume the firm is already using capital assets at full capacity. Assets Cash Accounts receivable Inventory Current assets Capital assets Total assets Assets (Click to select) (Click to select) (Click to select) Current assets (Click to select) Total assets The firm has an aftertax profit margin of 9 percent and a dividend payout ratio of 35 percent. a. If sales grow by 20 percent next year, determine how many dollars of new are needed to finance the expansion. (Do not round intermediate calculations. Enter the answer in millions. Round the final answer to 3 decimal places.) The firm needs $ Current ratio Total debt / assets b. Prepare a pro forma balance sheet with any financing adjustment made to long-term…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License