Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 17P

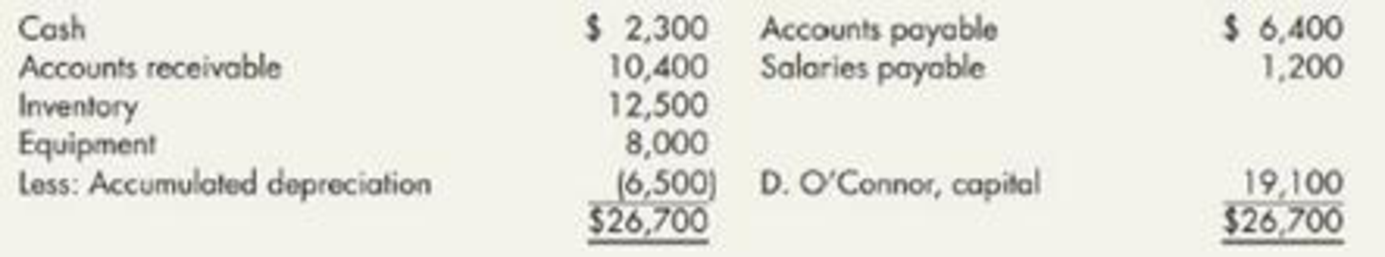

Comprehensive (Appendix 3.1) Dawson O’Connor is the owner of Miller Island Sales, a distributor of fishing supplies. The following is the

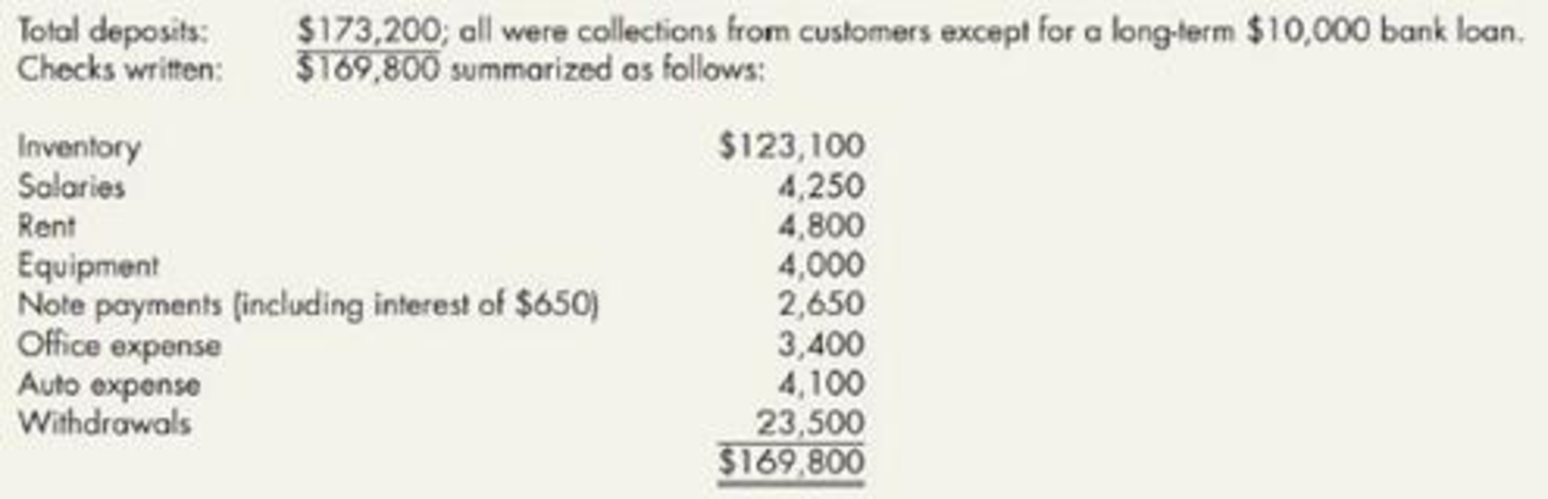

Dawson keeps very few records and has asked you to help him prepare the 2019 financial statements for Miller Island Sales. An analysis of the 2019 cash transactions recorded in the company’s checkbook indicates deposits and checks as follows:

Other information about the company is as follows:

- 1.

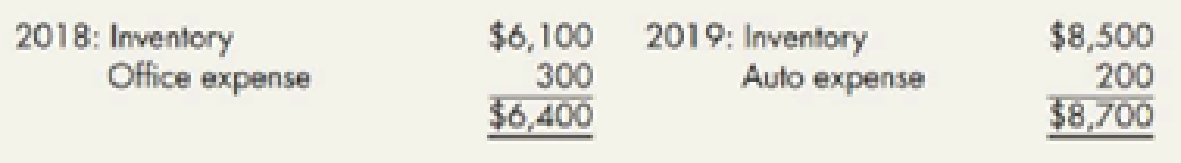

Accounts receivable at December 31, 2019; $9,200. - 2. Accounts payable at December 31:

- 3. Salaries payable at December 31, 2019, $1,800.

- 4. Equipment is depreciated by the straight-line method over a 10-year life. The equipment purchased in 2019 was acquired on July 1. All of the equipment will have zero salvage value at the end of its useful life.

- 5. Interest payable at December 31. 2019: $140.

- 6. The company uses a periodic inventory system Inventory at December 31, 2019: $17,400.

Required:

- 1. Prepare a worksheet to summarize the transactions and adjustments of Miller Island Sales for 2019. (Hint: Include debit and credit columns for both transactions and adjustments.)

- 2. Prepare a 2019 income statement and a balance sheet as of December 31, 2019. (Contributed by Waller A. Parker)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

ABC company are involved with the following transactions for 2021 from the books of the business. This company operates one bank account to reflect all cash and cheque transactions. You are now required to read these transactions carefully then prepare the relevant documents and books as outlined in the requirements below.

1 Aug 3 Aug

5 Aug

7 Aug 10 Aug 10 Aug

11 Aug

12 Aug

Started business with $150, 000 in the bank

Bought supplies on credit from Right Way Manufacturers

24 Boxes Air Filter

96 Bottles fuel injector cleaner 48 Boxes Spark Plug

36 Boxes Brake Shoe

24 Boxes Disc Pads

Provided services for cash less 10% discount 12 small motorbike engines

6 large motorbike engines (full service)

8 medium size motorbike engines (full service)

Paid Rent by cheque Paid Wages by cheque

Bought Fixtures from CT Limited paying by cash

Provided services on credit to Auto Care.

24 small motorbike engines

8 large motor bike engines (partial service)

12 medium size motorbike engine (partial service)…

As the accountant of the popular Italian restaurant, Magical Sicily, you have been requested to assist the bookkeeper to prepare the bank reconciliation statement at 31 March 2019.

The following information is provided:

The bank balance as per the general ledger at 31 March 2019 is an R5 158 in overdraft.

The bank balance as per the bank statement as at 31 March 2019 is a debit of R5 924.

The following transactions were identified to be on the bank statement and were not accounted for by the bookkeeper:

Bank charges amounted to R1 230.

Interest was paid on the overdraft to the value of R840.

The monthly debit order for the insurance premium to the value of R1 200.

A fixed deposit for R6 400 has matured. The capital sum plus interest of R300 had been transferred into the bank account.

The following items were identified in accounting records (general ledger bank account) that were not reflected on the bank statement:

The following cheques were issued during…

Odum Corporation’s cash account showed a balance of $17,000 on March 31, 2019. The bank statement balance for the same date indicated a balance of $17,711.55. The following additional information is available concerning Odum’s cash balance on March 31:

•

Undeposited cash on hand on March 31 amounted to $724.50.

•

A customer’s NSF check for $175.80 was returned with the bank statement.

•

A note for $2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified Odum of this collection on the bank statement.

•

The bank service charge for March was $15.

•

A deposit of $960.75 mailed to the bank on March 31 did not appear on the bank statement.

The following checks mailed to creditors had not been processed by the bank on March 31:

Check #

Amount

429

$57.40

432

147.50

433

210.80

434

191.90

A customer check for $149.50 in payment of his account and listed correctly for that amount on the bank statement had been incorrectly…

Chapter 3 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 3 - What is the primary purpose of an accounting...Ch. 3 - What is the relationship between the accounting...Ch. 3 - Show the expanded accounting equation using the 10...Ch. 3 - Explain and distinguish between a transaction; an...Ch. 3 - Explain how the accounting equation organizes...Ch. 3 - What is the difference between a permanent and a...Ch. 3 - Prob. 7GICh. 3 - Why is it advantageous to a company to initially...Ch. 3 - What is a perpetual inventory accounting system?...Ch. 3 - Give examples of transactions that: a. Increase an...

Ch. 3 - Give examples of transactions that: a. Increase...Ch. 3 - Prob. 12GICh. 3 - Prob. 13GICh. 3 - Prob. 14GICh. 3 - Prob. 15GICh. 3 - Explain and provide examples of deferrals,...Ch. 3 - Prob. 17GICh. 3 - Prob. 18GICh. 3 - Prob. 19GICh. 3 - Prob. 20GICh. 3 - Prob. 21GICh. 3 - What are the major financial statements of a...Ch. 3 - Prob. 23GICh. 3 - Prob. 24GICh. 3 - Prob. 25GICh. 3 - Prob. 26GICh. 3 - Prob. 27GICh. 3 - Prob. 28GICh. 3 - Prob. 29GICh. 3 - What is cash-basis accounting? What must a company...Ch. 3 - On May 1, Johnson Corporation purchased inventory...Ch. 3 - On January 1, Tolson Company purchased a building...Ch. 3 - On July 1, Friler Company purchased a 1-year...Ch. 3 - Prob. 4RECh. 3 - Garcia Company rents out a portion of its building...Ch. 3 - Prob. 6RECh. 3 - Goldfinger Corporation had account balances at the...Ch. 3 - Prob. 8RECh. 3 - For the current year, Vidalia Company reported...Ch. 3 - Use the information in RE3-6, (a) assuming Ringo...Ch. 3 - (Appendix 3.1) Vickelly Company uses cash-basis...Ch. 3 - Financial Statement Interrelationship Draw a...Ch. 3 - Journal Entries Mead Company uses a perpetual...Ch. 3 - Journal Entries The following are selected...Ch. 3 - Adjusting Entries Your examination of Sullivan...Ch. 3 - Adjusting Entries The following are several...Ch. 3 - Adjusting Entries The following partial list of...Ch. 3 - Basic Income Statement The following are selected...Ch. 3 - Periodic Inventory System Raynolde Company uses a...Ch. 3 - Closing Entries Lloyd Bookstore shows the...Ch. 3 - Financial Statements Turtle Company has prepared...Ch. 3 - Worksheet for Service Company Whitaker Consulting...Ch. 3 - Worksheet, Including Inventory Surian Motors...Ch. 3 - Reversing Entries On December 31, 2019, Kellams...Ch. 3 - Special Journals The following are several...Ch. 3 - (Appendix 3.1) Cash-Basis Accounting Puntarelli...Ch. 3 - Adjusting Entries The following information is...Ch. 3 - Prob. 2PCh. 3 - Adjusting Entries Sarah Companys trial balance on...Ch. 3 - Prob. 4PCh. 3 - Errors in Financial Statements At the end of the...Ch. 3 - Journal Entries, Posting, and Trial Balance Luke...Ch. 3 - Effects of Errors: During the current accounting...Ch. 3 - Financial Statements Mackenzie Inc. uses a...Ch. 3 - Prob. 9PCh. 3 - Worksheet Victoria Company has the following...Ch. 3 - Worksheet Devlin Company has prepared the...Ch. 3 - Comprehensive On November 30, 2019. Davis Company...Ch. 3 - Reversing Entries Thomas Company entered into two...Ch. 3 - Reversing Entries On December 31, 2019, Mason...Ch. 3 - Adjusting Entries At the end of 2019, Richards...Ch. 3 - Prob. 16PCh. 3 - Comprehensive (Appendix 3.1) Dawson OConnor is the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- he following information is produced by comparing the cash deposits and withdrawals recorded by the M&N Windows Ltd for the month with their most recent bank statement received at 30 June 2019: a. M&N Windows Ltd’ cash at bank ledger at 30 June 2019 is: $75,864 b. Credit balance as per bank statement as at 30 June 2019 is: $101,160 c. Bank statement shows an electronic transfer from a customer of $3,864 d. Deposits in transit, $12,540 e. Interest earned on bank account, $75 f. Unpresented cheques, $37,407 g. Service charge included in bank statement, $150 h. Cheque for insurance expense, $5,370 incorrectly recorded in books as $5,910 i. A dishonoured cheque written by a client Jim Smith, $3,900 The entity doesn’t use special journals for record keeping. The entity prepares bank reconciliation statement at the end of each month. Required: a) Prepare a bank reconciliation statement for M&N Windows Ltd at 30 June 2019. b) Discuss why a bank reconciliation is still necessary…arrow_forwardMcGuire Corporation began operations in 2024. The company purchases computer equipment from manufacturers and then sells to retail stores. During 2024, the bookkeeper used a check register to record all cash receipts and cash disbursements. No other journals were used. The following is a recap of the cash receipts and disbursements made during the year. O Cash receipts: Issue of common stock Collections from customers Borrowed from local bank on April 1, note signed requiring principal and interest at 12% to be paid on March 31, 2025 Total cash receipts Cash disbursements: Purchase of inventory Payment of salaries Purchase of office equipment Payment of rent on building Miscellaneous expense Total cash disbursements $ 75,000 335,000 37,000 $ 447,000 Required: Prepare an income statement for 2024 and a balance sheet as of December 31, 2024. $ 202,500 80,500 45,000 11,250 13,100 $352,350 You are called in to prepare financial statements on December 31, 2024. The following additional…arrow_forwardOn february 28th, 2022, Mark, the accountant of the scented candle business Smells LTD, prepared the documents for his february bank reconciliation. He noted a Cash balance of $15,534 in the general ledger. The bank statement on that date showed a balance of $17,675. A comparison of the bank statement with the cash account revealed the following The bank statement included service charges and card processing fees of $50 The bank statement included electronic collections (EFT) from customers, totaling $5,520. Smells LTD had not recorded the EFT yet A deposit of $200 made by another company was incorrectly added to Breathe-ins account by their bank Recent deposits worth $5,400 are not currently showing on the bank statement Cheques outstanding on January 31 totaled $3,754. Of these, $1,883 cleared the bank in February and are no longer outstanding. All new cheques written in February cleared the bank during the month Enter amounts with the final number rounded to the nearest $.…arrow_forward

- The bookkeeper for Blossom Manufacturing Ltd. was trying to determine what items would be used in preparing the company's bank reconciliation that she is completing at May 31, 2021, the end of the company's first month of operations. The company's bank statement showed the following: Date May 1 3 5 15 19 21 25 25 27 28 31 BLOSSOM MANUFACTURING LTD. Bank Statement May 31 NSF fee Description Deposit Cheque, No. 001 Cheque, No. 002 Deposit Cheque, No. 004 Cheque, No. 006 Returned cheque-NSF, S. Gillis Cheque, No. 009 Cheque, No. 010 Bank service charges Amounts Deducted from Account (Debits) 1.648 7,277 8,457 1,016 1,377 31 2,173 2,005 43 Amounts Added to Account (Credits) 25,500 4,743 Balance 25,500 23,852 16,575 21,318 12,861 11,845 10,468 10,437 8,264 6,259 6,216 Blossom's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following:arrow_forwardIn the draft accounts for the year ended 31 October 2019 of Thomas P Lee, garage proprietor, the balancE at bank according to the cash book was TZS 894.68 in hand. Subsequently the following discoveries were made: 1) Chegue number 176276 dated 3 September 2019 for TZS 310.84 in favour of GLowe Limited has been correctly recorded in the bank statement, but included in the cash book payments as TZS 301.84. 2) Bank commission charged of TZS 169.56 and bank interest charged of T2S 109.10 have been entered in the bank statement on 23 October 2019, but not included in the cash book. 3) The recently received bank statement shows that a cheque for TZS 29.31 received from TAndrews and credited in the bank statements on 9 October 20X9 has now been dishonored and debited in the bank statement on 26 October 2019. The only entry in the cash book for this chegue records its receipt on 8 October 20X9. 4) Cheque number 177145 for TZS 15.10 has been recorded twice as a credit in the cash book 5)…arrow_forwardThe accountant of Jonathan Manufacturing Company was tasked to perform monthly bank reconciliation. She downloaded the company’s April 30, 2019 bank statement that showed a balance of P32,400. She also printed the cash ledger from the company’s computerized accounting system. It contains the ending balance of P8,350. She also found the following reconciling items:a. The bank statement showed bank service fee of P800.b. The bank collected P1,500 from a note receivable for Jonathan Manufacturing. Also, a collection fee of P250.00 was charged.c. Deposit in transit, P51,000.d. Checks outstanding on April 30, P79,100.e. The accountant found a check issued to Rhys Corp. for P4,500 that cleared the bank but was not in the cash ledger. Requirement:a. Prepare the bank reconciliation statement.b. Journalize the adjusting entries.arrow_forward

- Required: (cashbook and bank statement attatched as images) (i)Calculate the balance as per the cash book (ii)Calculate the balances on the bank statement (iii)Prepare Adjusted cash book as at 31 December 2019 (iv) Prepare a Bank reconciliation statement. (b) Explain contra entry from purchases ledger to sales ledger (c)After the profit and loss account for Jebby Ltd had been prepared, it was found that prepaid expenses of Shs. 60,000 had been omitted and that closing stock had been overvalued by Shs.40,500. Explain the effect of these errors on the financial statements.arrow_forwardThe accountant of Sophia Manufacturing Company was tasked to perform monthly bank reconciliation. She downloaded the company’s April 30, 2019 bank statement that showed a balance of P32,400. She also printed the cash ledger from the company’s computerized accounting system. It contains the ending balance of P8,350. She also found the following reconciling items:a. The bank statement showed bank service fee of P800.b. The bank collected P1,500 from a note receivable for Sophia Manufacturing. Also, a collection fee of P250.00 was charged.c. Deposit in transit, P51,000.d. Checks outstanding on April 30, P79,100.e. The accountant found a check issued to Rhys Corp. for P4,500 that cleared the bank but was not in the cash ledger. Requirement:a. Prepare the bank reconciliation statement.b. Journalize the adjusting entries.arrow_forwardThe following information applies to the questions displayed below.] Rick Hall owns a card shop: Hall’s Cards. The following cash information is available for the month of August Year 1. As of August 31, the bank statement shows a balance of $13,250. The August 31 unadjusted balance in the Cash account of Hall’s Cards is $9,564. A review of the bank statement revealed the following information: A deposit of $1,250 on August 31, Year 1, does not appear on the August bank statement. It was discovered that a check to pay for baseball cards was correctly written and paid by the bank for $1,750 but was recorded on the books as $2,650. When checks written during the month were compared with those paid by the bank, three checks amounting to $4,095 were found to be outstanding. A debit memo for $59 was included in the bank statement for the purchase of a new supply of checks.arrow_forward

- [The following information applies to the questions displayed below.] Rick Hall owns a card shop: Hall’s Cards. The following cash information is available for the month of August Year 1. As of August 31, the bank statement shows a balance of $13,250. The August 31 unadjusted balance in the Cash account of Hall’s Cards is $9,564. A review of the bank statement revealed the following information: A deposit of $1,250 on August 31, Year 1, does not appear on the August bank statement. It was discovered that a check to pay for baseball cards was correctly written and paid by the bank for $1,750 but was recorded on the books as $2,650. When checks written during the month were compared with those paid by the bank, three checks amounting to $4,095 were found to be outstanding. A debit memo for $59 was included in the bank statement for the purchase of a new supply of checks. Section A: Record the entry to correct the error created while recording check for inventory. Section B: Record…arrow_forwardThe following information is produced by comparing the cash deposits and withdrawals recorded by the M&N Windows Ltd for the month with their most recent bank statement received at 30 June 2019:a. M&N Windows Ltd’ cash at bank ledger at 30 June 2019 is: $75,864b. Credit balance as per bank statement as at 30 June 2019 is: $101,160c. Bank statement shows an electronic transfer from a customer of $3,864d. Deposits in transit, $12,540e. Interest earned on bank account, $75f. Unpresented cheques, $37,407g. Service charge included in bank statement, $150h. Cheque for insurance expense, $5,370 incorrectly recorded in books as $5,910i. A dishonoured cheque written by a client Jim Smith, $3,900The entity doesn’t use special journals for record keeping. The entity prepares bank reconciliation statement at the end of each month.Required:a) Prepare a bank reconciliation statement for M&N Windows Ltd at 30 June 2019. b) Discuss why a bank reconciliation is still necessary even most of…arrow_forwardcan you help me answer these questions please... The accounting records for Delta Driving School shows a cash balance of $14,134 on February 28, 2019. On the evening of February 28, company receipts of $1,250 were placed in the bank's night deposit drop box. The deposit was processed by the bank on March 1. The February 28 bank statement shows a balance of $18,877, including collection of a $6,000 note receivable plus $55 of interest earned, a service charge of $40, and a $1,550 debit memo for the payment of the company's utility bill. All of the checks that the company had written were listed on the bank statement except for check #1908 in the amount of $1,528. Prepare a bank reconciliation to calculate the company’s adjusted cash balance at February 28, 2019. Prepare the journal entries needed to adjust the cash records as a result of the bank reconciliation. Circle the number that will appear as Cash on Delta’s Balance Sheet at February 28, 2019.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY