Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 17P

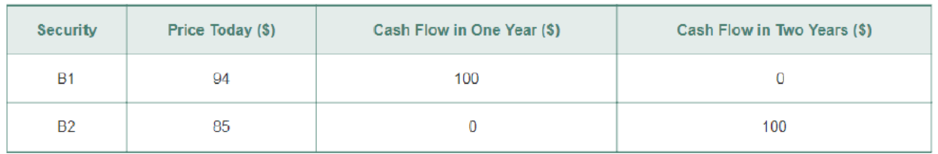

Consider two securities that pay risk-

- a. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $100 in two years?

- b. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $500 in two years?

- c. Suppose a security with cash flows of $50 in one year and $100 in two years is trading for a price of $130. What arbitrage opportunity is available?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

17. Consider two securities that pay risk-free cash flows over the next two years and that have the

current market prices shown here:

Security Price Today ($) Cash Flow in One Year ($) Cash Flow in Two Years ($)

B1

94

0

100

0

B2

85

100

a. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $100

in two years?

b. What is the no-arbitrage price of a security that pays cash flows of $100 in one year and $500

in two years?

c. Suppose a security with cash flows of $50 in one year and $100 in two years is trading for a

price of $130. What arbitrage opportunity is available?

Assume that the Pure Expectations Theory of the term structure is correct. Also

assume that the interest rate today on a 9-year security is 6.40%, while the

interest rate today on a 15-year security is 8.00%. Finally assume that the

interest rate on a 3-year security to be bought at Year 9 and held over Years 10,

11, and 12 is 6.80%. Given this information, determine the average annual return

that investors today must expect that they will receive from investing in a 3-year

security in 12 Years (that is, buying the security at Year 12 and holding it over

Years 13, 14, and 15).

O 13.00%

O 12.50%

13.50%

O 12.00%

O 14.00%

The promised cash flows of three securities are listed below. If the cash flows are risk-free, and the risk-free interest rate is 5.0%, determine the no-arbitrage price of each security before the first cash flow is paid.

Security

Cash Flow Today ($)

Cash Flow in One Year ($)

A

800

800

B

0

1600

C

1,600

0

The no-arbitrage price of security A is how much? ? (Round to the nearest cent.)

The no-arbitrage price of security B is how much? ? (Round to the nearest cent.)

The no-arbitrage price of security C is how much? ? (Round to the nearest cent.)

Chapter 3 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 3.1 - Prob. 1CCCh. 3.1 - If crude oil trades in a competitive market, would...Ch. 3.2 - How do you compare costs at different points in...Ch. 3.2 - Prob. 2CCCh. 3.3 - What is the NPV decision rule?Ch. 3.3 - Why doesnt the NPV decision rule depend on the...Ch. 3.4 - Prob. 1CCCh. 3.4 - Prob. 2CCCh. 3.5 - If a firm makes an investment that has a positive...Ch. 3.5 - Prob. 2CC

Ch. 3.5 - Prob. 3CCCh. 3.A - The table here shows the no-arbitrage prices of...Ch. 3.A - Suppose security Chas a payoff of 600 when the...Ch. 3.A - Prob. A.3PCh. 3.A - Prob. A.4PCh. 3.A - Prob. A.5PCh. 3.A - Consider a portfolio of two securities: one share...Ch. 3.A2 - Why does the expected return of a risky security...Ch. 3.A2 - Prob. 2CCCh. 3.A3 - Prob. 1CCCh. 3.A3 - Prob. 2CCCh. 3 - Honda Motor Company is considering offering a 2000...Ch. 3 - You are an international shrimp trader. A food...Ch. 3 - Prob. 3PCh. 3 - Prob. 4PCh. 3 - You have decided to take your daughter skiing in...Ch. 3 - Suppose the risk-free interest rate is 4%. a....Ch. 3 - You have an investment opportunity in Japan. It...Ch. 3 - Your firm has a risk-free investment opportunity...Ch. 3 - You run a construction firm. You have just won a...Ch. 3 - Your firm has identified three potential...Ch. 3 - Your computer manufacturing firm must purchase...Ch. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - An American Depositary Receipt (ADR) is security...Ch. 3 - Prob. 15PCh. 3 - An Exchange-Traded Fund (ETF) is a security that...Ch. 3 - Consider two securities that pay risk-free cash...Ch. 3 - Prob. 18P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the stand-alone risk? Use the scenario data to calculate the standard deviation of the bonds return for the next year.arrow_forwardConsider two securities that pay risk-free cash flows over the next two years and that have the current market prices shown here: (Click on the following icon in order to copy its contents into a spreadsheet.) Security B1 B2 Price Today $190 $176 Cash Flow in One Year $200 0 Cash Flow in Two Years 0 $200 a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? b. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $1,800 in two years? c. Suppose a security with cash flows of $100 in one year and $200 in two years is trading for a price of $260. What arbitrage opportunity is available? ... a. What is the no-arbitrage price of a security that pays cash flows of $200 in one year and $200 in two years? The no-arbitrage price is $ (Round to the nearest dollar.)arrow_forwardSuppose a stock is currently (time t = 0) worth 100. Further, suppose the one year annually compounded interest rate is 2%, and the two year annually compounded rate is 3%. Find the following:a) The forward price for a forward contract on the stock with maturity year T1 = 1. b) The forward price for a forward contract on the stock with maturity year T2 = 2.c) The forward price for a forward contract with maturity T1 = 1 on a ZCB with maturity T2 = 2.d) The forward price for a forward contract with maturity T1 = 1 on a forward contract on the stock with maturity T2 = 2 and delivery price K = 101.arrow_forward

- The prices of a certain security follow a geometric Brownian motion with parameters mu=.12 and sigma=.24. If the security's price is presently 40, what is the probability that a call option, having four months until its expiration time and with a strike price of K=42, will be exercised? (A security whose price at the time of expiration of a call option is above the strike price is said to finish in the money.) If the interest rate is 8%, what is the risk-neutral valuation of the call option?arrow_forwardAnswer the following two questions: a. A bond with a face value of $1200 has a 10% coupon rate, its current price is $950, and its price is expected to increase to $1000 next year. Calculate the expected rate of return. b. If the interest rate is 2 percent, what is the present value of a security that pays you $100 next year, $110 two years from now and $120 three years from now? If this security sold for $320 instead, is the yield to maturity greater or less than 2 percent? Explain why (No calculation needed).arrow_forwardRecall that on a one-year Treasury security the yield is 4.4600% and 6.0210% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.4%. What is the market’s estimate of the one-year Treasury rate one year from now? (Note: Do not round your intermediate calculations.arrow_forward

- Consider a state space model. Suppose there are two economic states in the next year.The probability of occurrence of state 1 is 0.29 and the probability of occurrence of state 2 is 0.71. There is a risk-free bond traded in this market with the time 1 payoff of $100. The time 0 price of the bond is $89.71.All primitive state-contingent claims are traded in this market. (a) The time 0 price of the state-contingent claim paying off $1 in state 1 is. What is the price of, the state-contingent claim paying off $1 in state 2? (b) Suppose that there is another security traded in this market: a stock paying $50.0 in state 1, and $100.0 in state 2. What is the time 0 price of the stock? (c) What is the expected return on the risk-free bond (in %)? (d) What is the expected return on the stock? (e) What is the standard deviation of the return of the bond? (f) What is the standard deviation of the return of the stock?arrow_forwardThe price of a certain security follows a geometric Brownian motion with drift parameter mu=.05 and volatility parameter sigma =.3. The present price of the security is 95. (a) If the interest rate is 4%, find the no-arbitrage cost of a call option that expires in three months and has exercise price 100. (b) What is the probability that the call option in part (a) is worthless at the time of expiration?arrow_forwardSuppose the real risk-free rate is 3.00%, the average expected future inflation rate is 4.00%, and a maturity risk premium of 0.10% per year to maturity applies, i.e., MRP = 0.10%(t), where t is the years to maturity. What rate of return would you expect on a 1-year Treasury security, assuming the pure expectations theory is NOT valid? Include the cross-product term, i.e., if averaging is required, use the geometric average. (Round your final answer to 2 decimal places.)arrow_forward

- Suppose that the standard deviation of quarterly changes in the prices of a commodity is $0.65, the standard deviation of quarterly changes in a futures price on the commodity is $0.81, and the coefficient of correlation between the two changes is 0.8. What is the optimal hedge ratio for a three-month contract? What does it mean? Explain what is meant by basis risk when futures contracts are used for hedging.arrow_forwardThe pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. Based on the pure expectations theory, is the following statement true or false? A certificate of deposit (CD) for two years will have the same yield as a CD for one year followed by an investment in another one-year CD after one year True False The yield on a one-year Treasury security is 5.6100%, and the two-year Treasury security has a 8.4200% yield. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? 14.3637% 9.6135% 11.3100% 12.8934% Recall that on a one-year Treasury security the yield is 5.6100% and 8.4200% on a two-year Treasury security. Suppose the one-year security does not have a maturity risk premium, but the two-year security does and it is 0.2000%. What is the market's estimate of the one-year Treasury rate one year from now? 12.4260%…arrow_forwardSuppose we observe the 3-year Treasury security rate (1R3) to be 8 percent, the expected 1-year rate next year—E(2r1)—to be 4 percent, and the expected one-year rate the following year—E(3r1)—to be 6 percent. If the unbiased expectations theory of the term structure of interest rates holds, what is the 1-year Treasury security rate, 1R1? (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License