Concept explainers

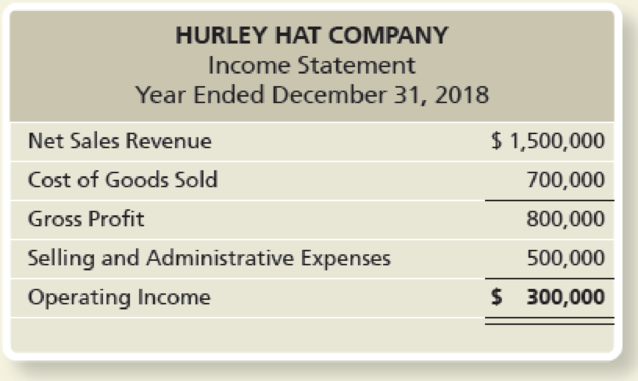

The Hurley Hat Company manufactures baseball hats. Hurley’s primary customers are sporting goods stores that supply uniforms to youth baseball teams. Following is Hurley’s income statement for 2018:

In 2018, Hurley produced and sold 200,000 baseball hats. Of the Cost of Goods Sold, $150,000 is fixed; 80% of the Selling and Administrative Expenses are fixed. There were no beginning inventories on January 1, 2018. The company is considering two options to increase sales.

Option 1: The company is operating at 100,000 hats below full production capacity and is considering increasing advertising to increase sales to the production capacity level in 2019. The marketing director predicts that an additional $100,000 expenditure for advertising would increase sales to 300,000 hats per year.

Option 2: The sales manager has been negotiating with buyers for several national sporting goods retailers and recommends the company expand production capacity to 400,000 hats in order to secure long-term contracts beginning in 2019. The expansion is expected to increase fixed

Requirements

- 1. Use the data from the 2018 income statement to prepare an income statement using variable costing. Assume no beginning or ending inventories. Calculate the contribution margin ratio. Round to two decimal places.

- 2. Prepare an absorption costing income statement assuming the company pursues Option 1 and increases advertising and production and sales increase to 300,000 hats.

- 3. Refer to the original data. Prepare an absorption costing income statement assuming the company pursues Option 2 and increases capacity and sales and production increases to 400,000 total hats.

- 4. Which option should the company pursue? Explain your reasoning.

Learn your wayIncludes step-by-step video

Chapter 21 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Construction Accounting And Financial Management (4th Edition)

Cost Accounting (15th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

- [The following information applies to the questions displayed below.]Shadee Corp. expects to sell 630 sun visors in May and 410 in June.Each visor sells for $24. Shadee’s beginning and ending finishedgoods inventories for May are 75 and 45 units, respectively. Endingfinished goods inventory for June will be 60 units.!Each visor requires a total of $4.00 in direct materials that includes an adjustableclosure that the company purchases from a supplier at a cost of $1.50 each. Shadeewants to have 31 closures on hand on May 1, 23 closures on May 31, and 20 closureson June 30. Additionally, Shadee’s fixed manufacturing overhead is $700 per month,and variable manufacturing overhead is $1.75 per unit produced.Required:1. Determine Shadee's budgeted cost of closures purchased for May and June.2. Determine Shadee's budget manufacturing overhead for May and June. Required 1 Required 2 arrow_forward[The following information applies to the questions displayed below.]Shadee Corp. expects to sell 630 sun visors in May and 410 in June.Each visor sells for $24. Shadee’s beginning and ending finishedgoods inventories for May are 75 and 45 units, respectively. Endingfinished goods inventory for June will be 60 units.!Each visor requires a total of $4.00 in direct materials that includes an adjustableclosure that the company purchases from a supplier at a cost of $1.50 each. Shadeewants to have 31 closures on hand on May 1, 23 closures on May 31, and 20 closureson June 30. Additionally, Shadee’s fixed manufacturing overhead is $700 per month,and variable manufacturing overhead is $1.75 per unit produced.Required:1. Determine Shadee's budgeted cost of closures purchased for May and June.2. Determine Shadee's budget manufacturing overhead for May and June. Required 1 Required 2 Complete this question by entering your answers in the tabs below.Determine Shadee's budget manufacturing…arrow_forwardMartinez Corporation runs two convenience stores, one in Connecticut and one in Rhode Island. Operating income for each store in 2017 is as follows: A (Click the icon to view the add-or-drop segments information.) (Click to view the operating income for the stores.) Read the requirements . Requirement 1. By closing down the Rhode Island store, Martinez can reduce overall corporate overhead costs by S41,000. Calculate Martinez's operating income if it closes the Rhode Island store. Is Maria Lopez's statement about the effect of closing the Rhode Island store correct? Explain. - X Begin by calculating Martinez's operating income if it closes the Rhode Island store. (Complete all ans parentheses or a minus sign.) let effect is an operating loss enter the amount with Data table (Loss in Revenues) Savings in Costs Connecticut Rhode Island Store Store Revenues Revenues 1,040,000 $ 820,000 Operating costs Operating costs Cost of goods sold Cost of goods sold 760,000 620,000 Lease rent…arrow_forward

- LOUD BASE WIRELESS sells a variety of mobile telephone accessories including several brands of Wireless Earbuds Bluetooth Headphones. The earbuds are sold in cases, with each case containing a pair of earbuds. LOUD BASE began the last quarter (October to December) of 2021 with 30 cases of the (TOZO T6) earbuds at a total cost of $187,800. During the quarter the business completed the following transactions relating to the “TOZO T6” earbuds 1. The West Indies School Book Shop sells T Shirts emblazoned with the school’s name and logo. The shirts cost $2,000 each and management estimates that 900 T Shirts will be sold during each month of the year. The annual holding cost for a unit of that inventory is estimated to be 1.5% of the purchase price. It costs the Book Shop $500 to place a single order. The maximum sale for the Book Shop for any one week is 300 shirts and minimum sales 150 shirts. The supplier takes anywhere from 2 to 4 weeks to deliver the merchandise after the order is…arrow_forwardMegatron Barber provides a standardised hair design and care service to customers. The price for each treatment is $60. At the beginning of February 2021, the owner proposed that Megatron Barber should launch a promotion since February is a traditional off-peak season. In this promotion, the selling price of each hair design would be reduced to $54, and the owner estimated that the promotion would increase sales volume by 40% compared with the sales volume in Feb 2020 (1,500 treatments). The owner of Megatron Barber reviewed the financial results for February 2021 after launching the promotion plan and compared them with the results in February 2020 (no promotion plan). He approaches you for help as he has some difficulties understanding the results. An extract of Megatron Barbers’ financial information for both February 2020 and 2021, based on sales of treatments, was as follows: Feb 2020 Feb 2021 Sales volume (units) 1,500 1,950 Selling price/unit ($) 60 54…arrow_forwardLOUD BASE WIRELESS sells a variety of mobile telephone accessories including several brands of Wireless Earbuds Bluetooth Headphones. The earbuds are sold in cases, with each case containing a pair of earbuds. LOUD BASE began the last quarter (October to December) of 2021 with 30 cases of the (TOZO T6) earbuds at a total cost of $187,800. During the quarter the business completed the following transactions relating to the “TOZO T6” earbuds: Unless otherwise stated, assume that all purchases were on account and received on the dates stated. Required: A) Prepare a perpetual inventory record for this merchandise, using the first in, first out (FIFO) method of inventory valuation to determine SOUND CORE’s cost of goods sold for the quarter and the value of ending.arrow_forward

- LOUD BASE WIRELESS sells a variety of mobile telephone accessories including several brands of Wireless Earbuds Bluetooth Headphones. The earbuds are sold in cases, with each case containing a pair of earbuds. LOUD BASE began the last quarter (October to December) of 2021 with 30 cases of the (TOZO T6) earbuds at a total cost of $187,800. During the quarter the business completed the following transactions relating to the “TOZO T6” earbuds: A) Journalize the transactions for the month of October, assuming the company uses a: - Periodic inventory system - Perpetual inventory systemarrow_forwardSOUND CORE WIRELESS sells a variety of mobile telephone accessories including several brands of Wireless Earbuds Bluetooth Headphones. The earbuds are sold in cases, with each case containing a pair of earbuds. SOUND CORE began the last quarter (October to December) of 2021 with 30 cases of the (TOZO T6) earbuds at a total cost of $187,800. During the quarter the business completed the following transactions relating to the "TOZO T6" earbuds: | October 8 98 cases were purchased at a cost of $6,202 each. In addition, the business paid a freight charge of $248 cash on each case to have the inventory shipped from the point of purchase to their place of business. October 31 The sales for October were 85 cases which yielded total sales revenue of $809,030. (25 of these cases were sold on account to three longstanding customers) A new batch of 67 cases was purchased at a total cost of $465,650 November 4 November 10 5 of the cases purchased on November 4 were returned to the supplier, as…arrow_forwardLOUD BASE WIRELESS sells a variety of mobile telephone accessories including several brands of Wireless Earbuds Bluetooth Headphones. The earbuds are sold in cases, with each case containing a pair of earbuds. LOUD BASE began the last quarter (October to December) of 2021 with 30 cases of the (TOZO T6) earbuds at a total cost of $187,800. During the quarter the business completed the following transactions relating to the “TOZO T6” earbuds A) Given that selling, distribution and administrative costs associated with the TOZO T6 brand of earbuds for the quarter were $42,844, $38,120 and $157,076 respectively, prepare an income statement for LOUD BASE WIRELESS (TOZO T6) for the quarter ended December 31, 2021.arrow_forward

- SOUND CORE WIRELESS sells a variety of mobile telephone accessories including several brands of Wireless Earbuds Bluetooth Headphones. The earbuds are sold in cases, with each case containing a pair of earbuds. SOUND CORE began the last quarter (October to December) of 2021 with 30 cases of the (TOZO T6) earbuds at a total cost of $187,800. During the quarter the business completed the following transactions relating to the “TOZO T6” earbuds: October 8 98 cases were purchased at a cost of $6,202 each. In addition, the business paid a freight charge of $248 cash on each case to have the inventory shipped from the point of purchase to their place of business. October 31 The sales for October were 85 cases which yielded total sales revenue of $809,030. (25 of these cases were sold on account to three longstanding customers) November 4 A new batch of 67 cases was purchased at a total cost of $465,650 November 10 5 of the cases purchased on November 4 were…arrow_forwardSOUND CORE WIRELESS sells a variety of mobile telephone accessories including several brands of Wireless Earbuds Bluetooth Headphones. The earbuds are sold in cases, with each case containing a pair of earbuds. SOUND CORE began the last quarter (October to December) of 2021 with 30 cases of the (TOZO T6) earbuds at a total cost of $187,800. During the quarter the business completed the following transactions relating to the “TOZO T6" earbuds: 98 cases were purchased at a cost of $6,202 each. In addition, the business paid a freight charge of $248 cash on each case to have the inventory shipped from the point of purchase to their place of business. October 8 The sales for October were 85 cases which yielded total sales revenue of $809,030. (25 of these cases were sold on account to three longstanding customers) October 31 November 4 A new batch of 67 cases was purchased at a total cost of $465,650 November 10 5 of the cases purchased on November 4 were returned to the supplier, as they…arrow_forwardSOUND CORE WIRELESS sells a variety of mobile telephone accessories including several brands of Wireless Earbuds Bluetooth Headphones. The earbuds are sold in cases, with each case containing a pair of earbuds. SOUND CORE began the last quarter (October to December) of 2021 with 30 cases of the (TOZO T6) earbuds at a total cost of $187,800. During the quarter the business completed the following transactions relating to the “TOZO T6” earbuds: October 8 98 cases were purchased at a cost of $6,202 each. In addition, the business paid a freight charge of $248 cash on each case to have the inventory shipped from the point of purchase to their place of business. October 31 The sales for October were 85 cases which yielded total sales revenue of $809,030. (25 of these cases were sold on account to three longstanding customers) November 4 A new batch of 67 cases was purchased at a total cost of $465,650 November 10 5 of the cases purchased on November 4 were…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education