Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.7MBA

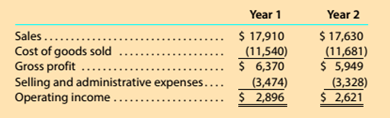

MBA 2-7 Common-sized income statements General Mills Inc. (GIS) produces. markets, and distributes cereal and food products including Cheerios. Wheaties, Cocoa Puffs. Yoplait, and Pillsbury branded products. The following part income statements (in millions) were adapted from recent financial statements.

Prepare common-sized income statements for Years 1 and 2. Round to one decimal place.

Using your answer to (1), analyze the performance of General Mills in Year 2.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Analyze and compare Clorox and Procter & Gamble

The Clorox Company (CLX) and The Procter & Gamble Company (PG) produce and sell packaged consumer products around the world. Income and interest expense information from financial statements for a recent year follows (in millions):

Clorox

Procter & Gamble

Interest expense

$88

$579

Income before income tax expense

983

13,369

a. Compute the times interest earned for each company. Round to one decimal place.

Clorox: fill in the blank 1

Procter & Gamble: fill in the blank 2

b. If you were a lender to these two companies, which one appears to have the greater coverage of interest expense and thus the greater protection for your loan interest?

Question 2Alex is currently considering to invest his money in one of the companies between Company A and Company B. The summarized final accounts of the companies for their last completed financial year are as follows:

a. Calculate the following ratios for Company A and Company B. State clearly the formulae used for each ratio:

i. Gross Profit Marginii. Net Profit Marginiii. Inventory Turnover Period (days)iv. Receivables Collection Period (days)

Revenue and expense data for Young Technologies Inc. are as follows:

Year 2

Year 1

Sales

$500,000

$440,000

Cost of goods sold

325,000

242,000

Selling expenses

70,000

79,200

Administrative expenses

75,000

70,400

Income tax expense

10,500

16,400

Required:

(a)

Prepare an income statement in comparative form, stating each item for both years as an amount and as a percent of sales. Round your percentages answers to one decimal place. Enter all amounts as positive numbers.

(b)

Comment on the significant changes disclosed by the comparative income statement.

Prepare an income statement in comparative form, stating each item for both years as an amount and as a percent of sales. Round your percentages answers to one decimal place. Enter all amounts as positive numbers.

Young Technologies Inc.

Comparative Income Statement

For the Years Ended December 31, Year 2 and Year 1

1

Year 2

Year 2

Year 1

Year 1…

Chapter 2 Solutions

Survey of Accounting (Accounting I)

Ch. 2 - The purchase of land for $50,000 cash was...Ch. 2 - The receipt of $8,000 cash for fees earned was...Ch. 2 - If total assets increased $20,000 during a period...Ch. 2 - Prob. 4SEQCh. 2 - Which of the following transactions changes only...Ch. 2 - Prob. 1CDQCh. 2 - Prob. 2CDQCh. 2 - Indicate whether the following error would cause...Ch. 2 - Prob. 4CDQCh. 2 - Prob. 5CDQ

Ch. 2 - Capstone Consulting Services acquired land 5 years...Ch. 2 - Prob. 7CDQCh. 2 - Assume that Esquire Consulting erroneously...Ch. 2 - Prob. 9CDQCh. 2 - Assume that as of January 1, 20Y8, Sylvester Con-...Ch. 2 - Using the January 1 and December 31, 20Y8, data...Ch. 2 - Accounting equation Determine the missing amount...Ch. 2 - Accounting equation The Walt Disney Company (DIS)...Ch. 2 - Accounting equation Campbell Soup Co. (CPB) had...Ch. 2 - Accounting equation The following are recent year...Ch. 2 - Prob. 2.5ECh. 2 - Effects of transactions on stockholders’ equity...Ch. 2 - Effects of transactions on Accounting equation...Ch. 2 - Effects of transactions on Accounting equation A...Ch. 2 - Effects of transactions on stockholders’ equity...Ch. 2 - Effects of transactions on Accounting equation On...Ch. 2 - Nature of transactions Cheryl Alder operates her...Ch. 2 - Net income and dividends The income statement of a...Ch. 2 - Net income and stockholders’ equity for four...Ch. 2 - Prob. 2.14ECh. 2 - Prob. 2.15ECh. 2 - Balance sheet, net income, and cash flows...Ch. 2 - Income statement After its first month of...Ch. 2 - Statement of stockholders’ equity Using the...Ch. 2 - Prob. 2.19ECh. 2 - Statement of cash flows Using the financial data...Ch. 2 - Effects of transactions on Accounting equation...Ch. 2 - Prob. 2.22ECh. 2 - Transactions and Financial statements Les Stanley...Ch. 2 - Transactions and Financial statements Les Stanley...Ch. 2 - Transactions and Financial statements Les Stanley...Ch. 2 - Transactions and Financial statements Les Stanley...Ch. 2 - Transactions and Financial statements Les Stanley...Ch. 2 - Transactions and Financial statements James...Ch. 2 - Transactions and Financial statements James...Ch. 2 - Transactions and Financial statements James...Ch. 2 - Transactions and Financial statements James...Ch. 2 - P2-3 Financial statements The following amounts...Ch. 2 - Financial statements Padget Home Services began...Ch. 2 - Financial statements Padget Home Services began...Ch. 2 - Financial statements Padget Home Services began...Ch. 2 - Financial statements Padget Home Services began...Ch. 2 - Missing amounts from Financial statements The...Ch. 2 - Financial statements Alpine Realty. Inc.,...Ch. 2 - Prob. 2.1MBACh. 2 - Prob. 2.2MBACh. 2 - MBA 2-3 Common-sized income statements Delta Air...Ch. 2 - MBA 2-4 Common-sized income statements Southwest...Ch. 2 - Prob. 2.5MBACh. 2 - MBA 2-6 Common-sized income statements Kellogg...Ch. 2 - MBA 2-7 Common-sized income statements General...Ch. 2 - Common-sized income statements Using your answers...Ch. 2 - Prob. 2.9.1MBACh. 2 - Prob. 2.9.2MBACh. 2 - Business emphasis Assume that you are considering...Ch. 2 - Business emphasis Assume that you are considering...Ch. 2 - Business emphasis Assume that you are considering...Ch. 2 - Prob. 2.2CCh. 2 - Prob. 2.3CCh. 2 - Prob. 2.4.1CCh. 2 - Prob. 2.4.2CCh. 2 - Financial information Yahoo.com’s (YHOO) finance...Ch. 2 - Prob. 2.4.4CCh. 2 - Prob. 2.4.6CCh. 2 - Prob. 2.4.7CCh. 2 - Prob. 2.4.8CCh. 2 - Prob. 2.4.9CCh. 2 - Financial information Yahoo.com’s (YHOO) finance...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (5th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals of Financial Accounting

Analysis of inventory errors A2 Hallam Company’s financial statements show the following. The company recently ...

FINANCIAL ACCT.FUND.(LOOSELEAF)

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

The managers of an organization are responsible for performing several broad functions. They are ______________...

Principles of Accounting Volume 2

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Grammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forwardReturn on assets The following data (in millions) were adapted from recent financial statements of Tootsie Roll Industries Inc. (TR): What is Tootsie Roll’s percent of the cost of sales to sales? Round to one decimal place.arrow_forwardCuneo Companys income statements for the last 3 years are as follows: Refer to the information for Cuneo Company above. Required: 1. Prepare a common-size income statement for Year 1 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 2 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 3. Prepare a common-size income statement for Year 3 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)arrow_forward

- Return on assets The following data (in millions) were adapted from recent financial statements of Tootsie Roll Industries Inc. (TR): The percent a company adds to its cost of sales to determine selling price is called a markup. What is Tootsie Roll’s markup percent? Round to one decimal place.arrow_forwardGross profit percent and markup percent Caterpillar Inc. (CAT) produces and sells various types of equipment. including tractors, loaders, and mining equipment. The following data (in millions) were adapted from recent financial statements of Caterpillar. Compute the gross profit percent for Years 1 and 2. Round to one decimal place.arrow_forwardCommon-sized income statements Using your answers to MBA 2-6 and MBA 2-7, compare and analyze Year 2 common-sized income statements of Keilogy (K) to those of General Milles (GIS).arrow_forward

- MBA 2-6 Common-sized income statements Kellogg Company (K) produces. markets, and distributes cereal and food products including Cheez-lt, Coco Pops. Rice Krispies. and Pringles. The following partial income statements (in millions) were adapted from recent financial statements. Prepare common-sized income statements for Years 1 and 2. Round to one decimal place. Using your answer to (1), analyze the performance of Kellogg in Year 2.arrow_forwardGross profit percent and markup percent Caterpillar Inc. (CAT) produces and sells various types of equipment. including tractors, loaders, and mining equipment. The following data (in millions) were adapted from recent financial statements of Caterpillar. Compute the average markup percent for Years 1 and 2. Round to one decimal place.arrow_forwardCuneo Companys income statements for the last 3 years are as follows: Refer to the information for Cuneo Company above. Required: 1. Prepare a common-size income statement for Year 2 by expressing each line item for Year 2 as a percentage of that same line item from Year 1. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 3 by expressing each line item for Year 3 as a percentage of that same line item from Year 1. (Note: Round percentages to the nearest tenth of a percent.)arrow_forward

- Comparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial information for Chipotle and Panera Bread reproduced at the back of the book and answer the following questions. What was the total revenue for each company for the most recent year? By what percentage did each companys revenue increase or decrease from its total amount in the prior year? What was each companys net income for the most recent year? By what percentage did each companys net income increase or decrease from its net income for the prior year? What was the total asset balance for each company at the end of its most recent year? Among its assets, what was the largest asset each company reported on its year-end balance sheet? Did either company pay its stockholders any dividends during the most recent year? Explain how you can tell.arrow_forwardPrepare a comparative common-size income statement for Jubilee Corporation. To an investor, how does the current year compare with the prior year? Explain your reasoning. E (Click the icon to view the comparative income statement.) Data table Start by calculating the percentages. (Round the percentages to two decimal places, X.XX.) Jubilee Corporation Comparative Common-Size Income Statement A C For the Years Ended December 31 1 Jubilee Corporation Current 2 Income Statement year Prior year 3 For the Years Ended December 31 Sales revenues 100.00 % 100.00 % 4 (amounts in thousands) Less: Cost of goods sold % % Current Gross profit % % year Prior year Less: Operating expenses % 6 Sales revenues $ 494,208 $ 429,000 % Operating income % 7 Less: Cost of goods sold 172,640 160,000 Less: Interest expense 8 Gross profit 2$ 321,568 $ 269,000 0% Income before income taxes % % 9 Less: Operating expenses 143,370 135,000 Less: Income tax expense 10 Operating income 2$ 178,198 $ 134,000 % % 11 Less:…arrow_forwardLewis Company has a condensed income statement as shown below. Sales Wages expense Rent expense Utilities expense Total operating expenses Net income Year 2 $178,400 $100,000 33,000 30,000 Sales Wages expense Rent expense Utilities expense $163,000 $15,400 Required: Prepare a horizontal analysis of Lewis Company's Income statements. Comment on the trends, both favorable and unfavorable. If required, round your answers to one decimal place. For those boxes in which you must enter subtractive or negative numbers use a minus sign. Year 1 $162,500 $92,500 30,000 25,000 $147,500 $15,000 Lewis Company Income Statement Year 2 Year 1 Increase/ (Decrease) Amount Percent Change 600 Garrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License