To determine: The after-tax cash flow to the shareholders if invested in T-Bills, after-tax cash flow to the shareholders if invested in

Introduction: The term dividends allude to that portion of proceeds of an organization which is circulated by the organization among its investors. It is the remuneration of the investors for investments made by them in the shares of the organization.

Answer to Problem 19QP

The after-tax cash flow to the shareholders if invested in T-Bills is $4,053,154.23, after-tax cash flow to the shareholders if invested in preferred stock is $4,361,828.43, the future value of T-Bills is $4,067,483.35 and the future value of preferred stock investment is $4,234,702.69.

Explanation of Solution

Option 1: If the company invest money currently

Determine the after-tax yield of corporate investment in T-bills

Therefore the after-tax yield of corporate investment in T-bills is 1.95%

Determine the future value of investment of corporate investment in T-bills

Therefore the future value of investment of corporate investment in T-bills is $4,768,416.74

Determine the after-tax cash flow to the shareholders if invested in T-Bills

Therefore the after-tax cash flow to the shareholders if invested in T-Bills is $4,053,154.23

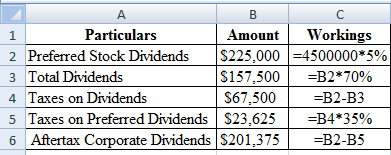

Determine the after-tax corporate dividends if invested in preferred stock

Using a excel spreadsheet we calculate the after-tax coporate dividends as,

Excel Spreadsheet:

Therefore the after-tax corporate dividends if invested in preferred stock is $201,375

Determine the after-tax yield of corporate investment in preferred stock

Therefore the after-tax yield of corporate investment in preferred stock is 4.48%

Determine the future value of investment of corporate investment in preferred stock

Therefore the future value of investment of corporate investment in preferred stock is $5,131,562.86

Determine the after-tax cash flow to the shareholders if invested in preferred stock

Therefore the after-tax cash flow to the shareholders if invested in preferred stock is $4,361,828.43

Option 2: If the company pay dividend currently

Determine the after-tax payments to shareholders

Therefore the after-tax payments to shareholders is $3,825,000

Determine the after-tax individual dividend yield on T-Bills

Therefore the after-tax individual dividend yield on T-Bills is 2.07%

Determine the future value if individual invest in T-Bill

Therefore the future value if individual invest in T-Bill is $4,067,483.35

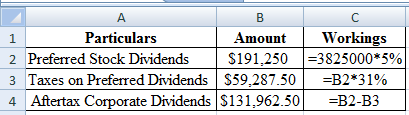

Determine the after-tax corporate dividends if individual invest in preferred stock

Using a excel spreadsheet we calculate the after-tax coporate dividends as,

Excel Spreadsheet:

Therefore the after-tax corporate dividends if individual in invest preferred stock is $131,962.50

Determine the after-tax yield preferred dividend yield

Therefore the after-tax yield preferred dividend yield is 3.45%

Determine the future value if individual invest in preferred stock

Therefore the future value if individual invest in T-Bill is $4,234,702.69

Want to see more full solutions like this?

Chapter 19 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Antonio Melton, the chief executive officer of Rooney Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $401,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 $84,000 Year 2 $99,000 Year 3 $130,000 Year 4 $184,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 10 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax deductible.…arrow_forwardAntonio Melton, the chief executive officer of Finch Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $417,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 $91,000 Year 2 $101,000 Year 3 $123,000 Year 4 $191,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 12 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax…arrow_forwardAntonio Melton, the chief executive officer of Solomon Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $418,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 $86,000 Year 2 $97,000 Year 3 $122,000 Year 4 $186,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 10 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax…arrow_forward

- Antonio Melton, the chief executive officer of Thornton Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $407,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 Year 3 Year 2 $100,000 Year 4 $190,000 $ 90,000 $127,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 10 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax…arrow_forwardAntonio Melton, the chief executive officer of Melton Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $500,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 $105,000 Year 2 $120,000 Year 3 $150,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 7 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Year 4. $225,000 Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax…arrow_forwardAntonio Melton, the chief executive officer of Melton Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $500,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 Year 2 Year 3 Year 4 $105,000 $120,000 $150,000 $225,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 7 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax deductible.…arrow_forward

- At this point, you may be confused why calling part of your in- vestment debt or equity makes a difference. Let’s walk through an example and compute your post-tax returns. Suppose $2 million of your investment is structured as debt and the remaining $8 million is equity. What happens each year after the company is set up? Well, using the $4 million EBIT, the company will first pay $2 million 50% = $1 million interest to you (as a debt investor). Then, on the remaining $4 $1 = $3 million of EBIT, the company pays corporate taxes of $3 20% = $0.6 million and is left with $2.4 million, which will be paid out to you (the equity holder) as dividend. Income Statement EBIT 4 -Interest expense 1 -Corporate taxes .6 = Net income of 2.4 million Therefore, the total returns to you (as an investor) is $1 million in interest and $2.4 million in dividends, which is a total of $3.4 million.4 Uncle Sam collected $0.6 million. The company will go bankrupt if its EBIT is strictly less than interest…arrow_forwardPenny Arcades, Inc., is trying to decide between the following two alternatives to finance its new $34 million gaming center: a. Issue $34 million of 6% bonds at face amount.b. Issue 1 million shares of common stock for $34 per share. 1. Assuming bonds or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. (Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000). Round your "Earnings per Share" to 2 decimal places. Round your "Earnings per Share" to 2 decimal places.) Issue Bonds Issue stock Operating income 10,900,000 10,900,000 Interest expense (bonds only) Income before tax Income tax expense (40%) Net Income Number of shares 3,900,000 4,900,000 Earnings per sharearrow_forwardBank A has the following balance sheet: A ssets Reserves $50 million Liabilities Deposits $200 million Bank capital 850 million Securities $50 million Loans $150 million Bank B has the following balance sheet: A ssets Liabilities Deposits $225 million Bank capital $25 million Reserves $50 million Securities $50 million Loans $150 million 1. Both banks earn 85 million as an annual after-tax profit. Calculate ROA (return on asset) and ROE (return on equity) for both banks.arrow_forward

- Seattle Adventures, Incorporated, is trying to decide between the following two alternatives to finance its new $17 million gaming center: a. Issue $17 million, 6% note. b. Issue 1 million shares of common stock for $17 per share with expected annual dividends of $1.02 per share. Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. 2. Answer the following questions for the current year: (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share?arrow_forwardPenny Arcades, Incorporated, is trying to decide between the following two alternatives to finance its new $35 million gaming center. a. Issue $35 million, 7% note b. Issue 1 million shares of common stock for $35 per share with expected annual dividends of $2.45 per share. Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. 2. Answer the following questions for the current year (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Answer the following questions for the current year: (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share? (Enter…arrow_forwardRustic Campsites, Incorporated, is trying to decide between the following two alternatives to finance its new $34 million gaming center. a. Issue $34 million, 6% note. b. Issue 1 million shares of common stock for $34 per share with expected annual dividends of $2.04 per share. Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. 2. Answer the following questions for the current year: (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. (Enter your answers in dollars, not millions (ie, $5.5 million should be entered as 5,500,000). Round your…arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning