Concept explainers

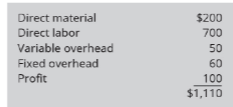

Blake Cohen Painting Service specializes in small paint jobs. His normal charge is $350/day plus materials. Moesha needs her basement painted. Blake has produced a bid for $1 500 to complete the basement painting. Blake completed a cost estimate for his service as shown.

A. Moesha mentions that she can’t pay the $1500. She is a widow and you feel an obligation to take care of widows but can’t lose money. How much would you charge and still be able to make a profit?

B. Moesha has asked you to paint the rest of her house. Could you continue to give her the same deal?

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Principles of Accounting Volume 2

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Cost Accounting (15th Edition)

Financial Accounting (12th Edition) (What's New in Accounting)

Financial Accounting (11th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Horngren's Accounting (11th Edition)

- Myrna White is a mobile housekeeper. The price for a standard house cleaning is $150 and takes 5 hours. Each worker is paid $25/hour, uses $15 of materials and $0.50 per mile to use their own vehicle to travel from job to job. The average job is 5 miles. Arniz Meyroyan has a family reunion at her house and needs her house freshened up. She offers $75 for this emergency tidy-up service. This service includes vacuuming and cleaning floors, dusting, and cleaning the bathrooms. Only $5 of materials would be used. A. Prepare an Excel spread sheet to determine the differential income if the emergency tidy-up service is priced at $75. The tidy-up service will take 2 hours. B. If a $25 surcharge was included to make the price of $100 how would the differential income change? C. If the hourly worker rate increased to $30/hour, how would net income change? D. What other issue would you need to consider?arrow_forwardGrace Kelly is a high school student who has been investigating the possibility of mowing lawns for a summer job. She has a couple of friends she thinks she could hire on an hourly basis per job. The equipment, including two new lawnmowers and weed-eaters, would cost her €500, and she estimates her cost per lawn, based on the time required to pay her friends to mow an average residential lawn (and not including her own labour) and gas for driving to the jobs and mowing, would be about €14. a) If she charges customers €30 per lawn, how many lawns would she need to mow to break even? Represent this graphically b) Grace has 8 weeks available to mow lawns before school starts again, and she estimates that she can get enough customers to mow at least 3 lawns per day, 6 days per week. How much money can she expect to make over the summer? c) Grace believes she can get more business if she lowers her price per lawn. If she lowers her price to €25 per lawn and increases her number of jobs to 4…arrow_forwardStaci Valek began dabbling in pottery several years ago as a hobby. Her work is quite creative, and it hasbeen so popular with friends and others that she has decided to quit her job with an aerospace company andmanufacture pottery full time. The salary from Staci’s aerospace job is $3,800 per month.Staci will rent a small building near her home to use as a place for manufacturing the pottery. Therent will be $500 per month. She estimates that the cost of clay and glaze will be $2 for each finishedpiece of pottery. She will hire workers to produce the pottery at a labor rate of $8 per pot. To sell herpots, Staci feels that she must advertise heavily in the local area. An advertising agency states that it willhandle all advertising for a fee of $600 per month. Staci’s brother will sell the pots; he will be paid acommission of $4 for each pot sold. Equipment needed to manufacture the pots will be rented at a costof $300 per month.Staci has already paid the legal and filing fees…arrow_forward

- Mary's job position is being transferred to Lexington, Kentucky from Orlando, Florida. She andher husband George are currently renting their home in Orlando, but they have decided that they want to purchase a home in Lexington. Mary's annual salary is $48,500. George has also beenable to find employment in Lexington at a factory making $39,000 per year. Mary is a planner and has saved $6200 that she can use towards the down payment on the new house. Use the above information to answer the following questions. Round all answers to 2 decimal places. 1. To save the down payment, Mary deposited monthly in a savings account earning 2.5% compounded monthly. If it took Mary 5 years to save up the down payment,how much money was Mary depositing each month? 2. If Mary and George don't want to spend more than 15% of theirmonthly income on their house payment, what is the maximum monthly payment they can afford?arrow_forwardLaMont works for a company in downtown Chicago. The firm encourages employees to use public transportation (to save the environment) by providing them with transit passes at a cost of $270 per month. a. If LaMont receives one pass (worth $270) each month, how much of this benefit must he include in his gross income each year? b. If the company provides each employee with $270 per month in parking benefits, how much of the parking benefit must LaMont include in his gross income each year?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT