Concept explainers

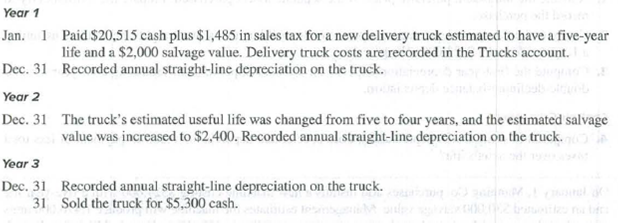

Yoshi Company completed the following transactions and events involving its delivery trucks.

Required

Prepare

Prepare journal entries to record the given transaction and events.

Explanation of Solution

Plant assets:

Plant assets refer to the fixed assets, having a useful life of more than a year that is acquired by a company to be used in its business activities, for generating revenue.

Prepare journal entries to record the given transaction and events as follows:

Year 1:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| January 1, Year 1 | Trucks (1) | 22,000 | ||

| Cash | 22,000 | |||

| (To record the purchase of truck) |

Table (1)

- Truck is an asset account and it increases the value of asset. Therefore, debit the trucks account by $22,000.

- Cash is an asset account and it decreases the value of asset. Therefore, credit Cash account by $22,000.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 1 | Depreciation Expense (2) | 4,000 | ||

| Accumulated Depreciation – Trucks | 4,000 | |||

| (To record the depreciation expense for truck) |

Table (2)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $4,000.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $4,000.

Working Notes:

Compute the acquisition cost of truck:

Compute depreciation expense:

Year 2:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 2 | Depreciation Expense (5) | 5,200 | ||

| Accumulated Depreciation – Trucks | 5,200 | |||

| (To record the depreciation expense for truck) |

Table (3)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $5,200.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $5,200.

Working Notes:

Compute the remaining depreciable amount:

| Computation of Depreciation | |

| Particulars | $ |

| Acquisition cost, January 1, Year 1 | $22,000 |

| Less: Accumulated depreciation for first year | (4,000) |

| Book value | 18,000 |

| Less: Revised salvage value | (2,400) |

| Remaining depreciable amount | $15,600 |

Table (4)

…… (4)

Compute the revised depreciation for year 2

Year 3:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 3 | Depreciation Expense (5) | 5,200 | ||

| Accumulated Depreciation – Trucks | 5,200 | |||

| (To record the annual depreciation expense for truck) |

Table (5)

- Depreciation expense is an expense account, and it decreases the value of equity. Hence, debit the depreciation expense by $5,200.

- Accumulated depreciation is a contra asset, and it decreases the value of assets. Therefore, credit the accumulated depreciation by $5,200.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, Year 3 | Cash | 5,300 | ||

| Accumulated Depreciation – Trucks (6) | 14,400 | |||

| Loss on disposal of trucks (6) | 2,300 | |||

| Trucks | 22,000 | |||

| (To record the sale of truck) |

Table (6)

- Cash is an asset account and it increases the value of asset. Therefore, debit cash account by $5,300.

- Accumulated depreciation is a contra asset, and it increases the value of assets. Therefore, debit the accumulated depreciation by $14,400.

- Loss on sale of truck is an expense account and it decreases the value of stockholder’s equity. Therefore, debit the loss on sale of truck by $2,300.

- Truck is an asset account and it decreases the value of asset. Therefore, credit the trucks account by $22,000.

Working Notes:

Compute the gain or loss on the sale of truck:

| Computation of Gain or Loss on Sale of Truck | ||

| Details | Amount ($) | Amount ($) |

| Cost of the Asset | 22,000 | |

| Less: Accumulated depreciation | ||

| Year 1 (2) | 4,000 | |

| Year 2 (5) | 5,200 | |

| Year 3 (5) | 5,200 | (14,400) |

| Book value of asset | 7,600 | |

| Less: sold value of truck | 5,300 | |

| Loss on sale of Truck | (2,300) | |

Table (7)

...... (6)

Want to see more full solutions like this?

Chapter 10 Solutions

Principles of Financial Accounting.

- Record journal entries for the following transactions of Commissary Productions.arrow_forwardTYPES OF FILES For each of the following records, indicate the appropriate related file structure: master file, transaction file, reference file, or archive file. a. customer ledgers b. purchase orders c. list of authorized vendors d. records related to prior pay periods e. vendor ledgers f. hours each employee has worked during the current pay period g. tax tables h. sales orders that have been processed and recordedarrow_forwardRecord the following transactions for Redeker Co. in the general journal.arrow_forward

- The purchases and disbursements cycle usually begins when Group of answer choices A user department requests for acquisition of goods or services and submits purchase requisition to the purchasing department. A check is issued to the vendor or supplier. The warehouse received the goods from the vendor or supplier. The accounting posts the purchase transaction in the accounts payable ledger.arrow_forwardThe journal entry recorded for the sale of office equipment includes:arrow_forwardthe purchases and disbursements cycle usually begins when a. a user department request for acquisition of goods or services and submits purchase requisition to the purchasing department b. a check is issued to the vendor or supplier c. the warehouse is received the goods from the vendor or supplier d. the accounting posts the purchase transaction in the accounts payable ledgerarrow_forward

- The following  transactions occurred for Lawrence engineering Post the transactions to the T-accountsarrow_forwardUsing the following revenue journal for Bowman Cleaners Inc., identify each of the postingreferences, indicated by a letter, as representing (1) posting to general ledger accounts or(2) posting to subsidiary ledger accounts:arrow_forwardprovide journal entries for the transaction letters: J, K, Larrow_forward

- Post the following general journal entries to the general ledger?arrow_forwardRecord journal entries for the following transactions of Telesco Enterprises.arrow_forwardFor each of the following records, indicate the appropriate related file structure: master file, transaction file, reference file, or archive file.a. customer ledgersb. purchase ordersc. list of authorized vendorsd. records related to prior pay periodse. vendor ledgersf. hours each employee has worked during the current pay periodg. tax tablesh. sales orders that have been processed and recordedarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning