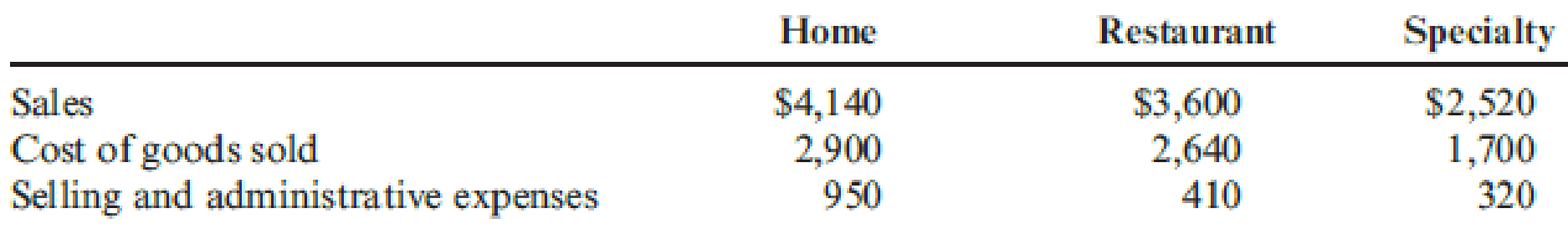

Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands):

The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenold’s total capital employed is $5.04 million ($2,600,000 for the Home Division, $1,700,000 for the Restaurant Division, and the remainder for the Specialty Division).

Required:

- 1. Prepare a segmented income statement for Xenold, Inc., for last year.

- 2. Calculate Xenold’s weighted average cost of capital. (Round to four significant digits.)

- 3. Calculate EVA for each division and for Xenold, Inc.

- 4. Comment on the performance of each of the divisions.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Cora Manufacturing makes fashion products and competes on the basis of quality and leading-edge designs. The company has two divisions, clothing and cosmetics. Cora has $5,000,000 invested in assets in its clothing division. After-tax operating income from sales of clothing this year is $1,000,000. The cosmetics division has $12,500,000 invested in assets and an after-tax operating income this year of $2,000,000. The weighted-a verage cost of capital for Cora is 6%. The CEO of Cora has told the manager of each division that the division that “performs best” this year will get a bonus. Q.What nonfinancial measures could Cora use to evaluate divisional performances?arrow_forwardBurdeno Appliances has two divisions, Sales and Financing. Sales is responsible for selling Burdeno's inventory and maintaining inventory for future sale. Financing Division takes loan applications, packages loans into pools, and sells them in the financial markets. It also services the loans. Both divisions meet the requirements for segment disclosures under accounting rules. Sales Division had $8 million in sales last year. Costs, other than those charged by Financing Division, totaled $6 million. Financing Division earned revenues of $2.5 million from servicing loans and incurred outside costs of $3 million. In addition, Financing charged Operations $900,000 for loan-related fees. Sales' manager complained to corporate that Financing was charging 150 percent of the commercial rate for loan-related fees and that Sales would be better off sending its buyers to an outside lender Financing's manager replied that although commercial rates could be lower, servicing these loans is more…arrow_forwardD&G Textile company is evaluating two different operating structures. Data about those structures are shown below. Annual interest expense of the firm is $200, it has common shares outstanding of 2,000, and a tax rate of 20 percent.arrow_forward

- Giardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.230 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Revenues($000) Transactions(000) Online $ 75,300 1,366.5 Stores 41,100 433.5 Required: What is the F and A cost that is charged to each division if divisional revenues are used as the allocation basis? What is the F and A cost that is charged to each division if the the number of transactions is used as the allocation basis?arrow_forwardCeradyne Mills is a division of lowa Woolen Products. For the most recent year, Ceradyne had net income of $20,400,000. Included in income was interest expense of $1,148,000. The operation's tax rate is 15 percent. Total assets of Ceradyne Mills are $192,700,000, current liabilities are $42,640,000, and $29,520,000 of the current liabilities are noninterest bearing. Calculate NOPAT, invested capital, and ROI for Ceradyne Mills. (Round ROI to 2 decimal places, e.g. 5.25%.) NOPAT tA Invested capital $ ROI %arrow_forwardGiardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.245 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Online Stores Required A Revenues ($000) Required: a. What is the F and A cost that is charged to each division if divisional revenues are used as the allocation basis? b. What is the F and A cost that is charged to each division if the the number of transactions is used as the allocation basis? $ 75,900 41,700 Complete this question by entering your answers in the tabs below. Division Online Stores Transactions (000) 1,516.5 508.5 Required B What is the F and A cost that is charged to each division if divisional revenues are used as the allocation basis? Note: Do not…arrow_forward

- Giardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.225 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Revenues ($000) $ 75, 100 40,900 Online Stores Required: Determine the cost allocation if $3.825 million of the F and A costs are fixed and allocated on the basis of revenues, and the remaining costs, which are variable, are allocated on the basis of transactions. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Fixed Variable Total Transactions (000) 1,316.5 408.5 Online Storesarrow_forwardLasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) RAD expenditures Carolinas $1,600 160 1,000 240 800 Northeast $5,500 Complete this question by entering your answers in the tabs below. 432 1,500 240 720 R&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA). a-2. Which division had the better performance?arrow_forwardFortunate Inc. is involved in retailing and has three profit centers classified as “East” and “West” and “South.” East Division sold 38,000 units during the year for a selling price of $25 each—These items cost $15 each and had $2.50 of variable selling expenses (sales commissions) that could be directly traced to the units. West Division sold 16,000 units during the year for a selling price of $27 each—These items cost $17 each and that had $3 of variable selling expenses (sales commissions) that could be directly traced to the units. South Division sold 42,000 units during the year for a selling price of $26 each—These items cost $16 each and had $2 of variable selling expenses (sales commissions) that could be directly traced to the units. Fixed Division Operating Costs that could be directly traced to the divisions were $160,000 for East Division and $95,000 for West Division, and $200,000 for South Division. There were $230,000 of Corporate Costs (which was $20,000 for…arrow_forward

- Giardin Outdoors is a recreational goods retailer with two divisions: Online and Stores. The two divisions both use the services of the corporate Finance and Accounting (F and A) Department. Annual costs of the F and A Department total $5.215 million a year. Managers in the two operating divisions are measured based on division operating profits. The following selected data are available for the two operating divisions: Online Stores Revenues ($000) Fixed Variable Total $ 74,700 40,500 Required: Determine the cost allocation if $3.815 million of the F and A costs are fixed and allocated on the basis of revenues, and the remaining costs, which are variable, are allocated on the basis of transactions. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Transactions_ (000) 1,216.5 358.5 Online Storesarrow_forwardThe Emergency Medical Services Company has two divisions that operate independently of one another. The financial data for the year 20X5 reported the following results: North South Sales $3,720,000 $3,220,000 Operating income 930,000 730,000 Taxable income 785,000 510,000 Investment 6,000,000 5,000,000 The company's desired rate of return is 10%. Income is defined as operating income. a. What are the respective return-on-investment ratios for the North and South divisions? Round ROI to the nearest whole percentage. North: Answer South: Answer b. What are the respective residual incomes of the North and South divisions? North: Answer South: Answer c. Which division has the better return on investment and which division has the better residual income figure? Return on investment: Answer Residual Income: Answerarrow_forwardThe Bedding Division of Homestore Corporation had sales of $9,000,000 and operating income of $1,620,000 last year. The total assets of the Bedding Division were $2,500,000, while current liabilities were $310,000. Homestore Corporation's target rate of return is 11%, while its weighted average cost of capital is 9%. The effective tax rate for the company is 25%. What is the Bedding Division's capital turnover? OA. 29 OB. 3.6 OC. 8.1 O D. 5.6 (...)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub