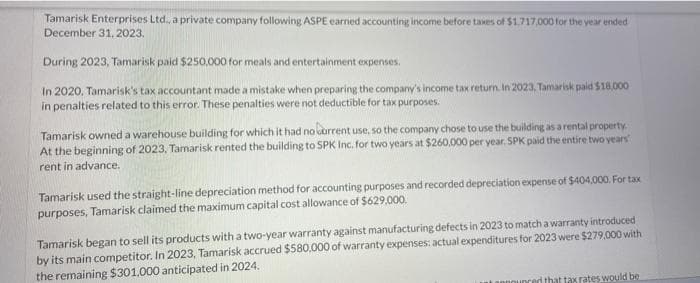

Tamarisk Enterprises Ltd., a private company following ASPE earned accounting income before taxes of $1,717,000 for the year ended December 31, 2023. During 2023, Tamarisk paid $250,000 for meals and entertainment expenses. In 2020, Tamarisk's tax accountant made a mistake when preparing the company's income tax return. In 2023, Tamarisk paid $18,000 in penalties related to this error. These penalties were not deductible for tax purposes. Tamarisk owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At the beginning of 2023, Tamarisk rented the building to SPK Inc. for two years at $260,000 per year. SPK paid the entire two years rent in advance. Tamarisk used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $404,000. For tax purposes, Tamarisk claimed the maximum capital cost allowance of $629,000. Tamarisk began to sell its products with a two-year warranty against manufacturing defects in 2023 to match a warranty introduced by its main competitor. In 2023, Tamarisk accrued $580,000 of warranty expenses: actual expenditures for 2023 were $279,000 with the remaining $301,000 anticipated in 2024. d that tax rates would be In 2023, Tamarisk was subject to a 35% income tax rate. During the year, the federal government announced that tax rates would be decreased to 33% for all future years beginning January 1, 2024 (a) Your answer is incorrect. Calculate the amount of any permanent differences for 2023. Permanent differences $ 18000

Tamarisk Enterprises Ltd., a private company following ASPE earned accounting income before taxes of $1,717,000 for the year ended December 31, 2023. During 2023, Tamarisk paid $250,000 for meals and entertainment expenses. In 2020, Tamarisk's tax accountant made a mistake when preparing the company's income tax return. In 2023, Tamarisk paid $18,000 in penalties related to this error. These penalties were not deductible for tax purposes. Tamarisk owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At the beginning of 2023, Tamarisk rented the building to SPK Inc. for two years at $260,000 per year. SPK paid the entire two years rent in advance. Tamarisk used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $404,000. For tax purposes, Tamarisk claimed the maximum capital cost allowance of $629,000. Tamarisk began to sell its products with a two-year warranty against manufacturing defects in 2023 to match a warranty introduced by its main competitor. In 2023, Tamarisk accrued $580,000 of warranty expenses: actual expenditures for 2023 were $279,000 with the remaining $301,000 anticipated in 2024. d that tax rates would be In 2023, Tamarisk was subject to a 35% income tax rate. During the year, the federal government announced that tax rates would be decreased to 33% for all future years beginning January 1, 2024 (a) Your answer is incorrect. Calculate the amount of any permanent differences for 2023. Permanent differences $ 18000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

vi.3

Transcribed Image Text:Tamarisk Enterprises Ltd., a private company following ASPE earned accounting income before taxes of $1,717,000 for the year ended

December 31, 2023.

During 2023, Tamarisk paid $250,000 for meals and entertainment expenses.

In 2020, Tamarisk's tax accountant made a mistake when preparing the company's income tax return. In 2023, Tamarisk paid $18,000

in penalties related to this error. These penalties were not deductible for tax purposes.

Tamarisk owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property.

At the beginning of 2023, Tamarisk rented the building to SPK Inc. for two years at $260,000 per year. SPK paid the entire two years

rent in advance.

Tamarisk used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $404,000. For tax

purposes, Tamarisk claimed the maximum capital cost allowance of $629,000.

Tamarisk began to sell its products with a two-year warranty against manufacturing defects in 2023 to match a warranty introduced

by its main competitor. In 2023, Tamarisk accrued $580,000 of warranty expenses: actual expenditures for 2023 were $279,000 with

the remaining $301,000 anticipated in 2024.

d that tax rates would be

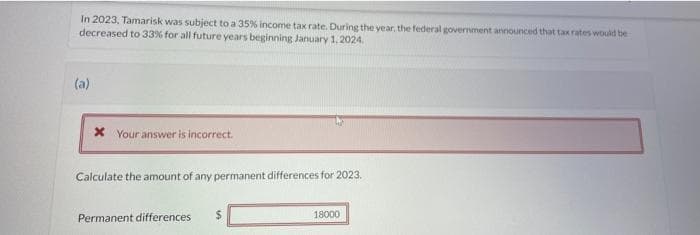

Transcribed Image Text:In 2023, Tamarisk was subject to a 35% income tax rate. During the year, the federal government announced that tax rates would be

decreased to 33% for all future years beginning January 1, 2024

(a)

Your answer is incorrect.

Calculate the amount of any permanent differences for 2023.

Permanent differences

$

18000

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT